Industry101: Capital Markets

This article is for someone looking to understand this industry, its working, and its offerings.

Table of Contents

Hey there!

Last week, I wrote a 101 on India's Insurance Industry. This week we're diving into a more exciting industry - the Capital Market Industry.

Heavily regulated, of interest to virtually everyone, invites some of the brightest minds to work in it - the Capital Market Industry has been on a roll.

This article is for someone looking to understand this industry, its working and its offerings. It may make them rethink their approach towards various market participants.

Let's get started.

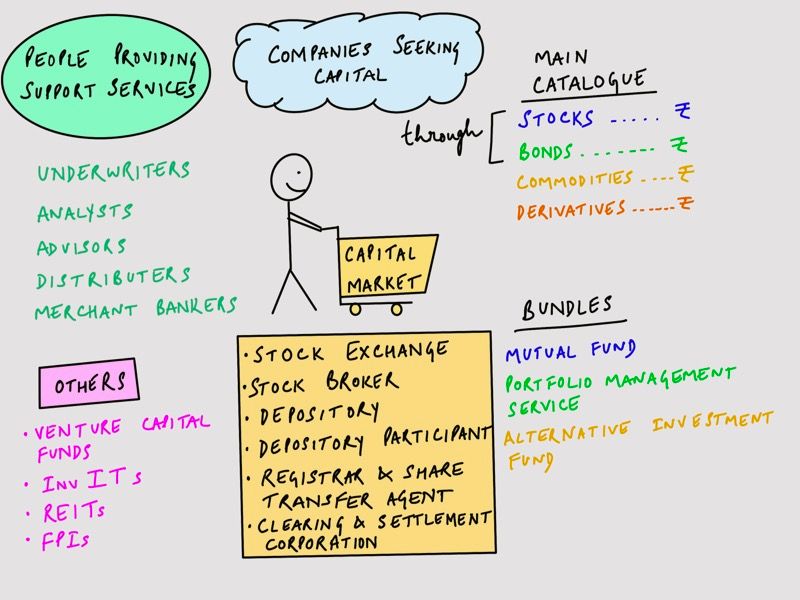

Making Sense of Capital Markets

We'll use a simple example to make sense of all this - think of the capital market as a flea market. In every point below I'll explain one participant.

- The organiser of the flea market is the stock exchange (BSE, NSE). They organise the whole thing and are responsible for its functioning.

- People who have capital to deploy come here to find avenues for deployment.

- Companies that want capital, come in search of it. They can either take capital from people and give them part-ownership of their company in return, or they can borrow capital and return it later (along with interest).

- When they choose the first option - they issue equity shares / stocks to the person giving them that capital.

- And when they choose the second option - they issue bonds / debentures to the person giving them the capital. At a basic level, these five are all it takes to have a functioning capital market. But through time, both popularity and complexity have increased, and more participants have entered the flea market. And thus, more options have made their way into the catalogue. It's also pertinent to note that, once a company issues its stocks or bonds, people freely buy and sell them in this market.

- The organiser of this flea market - the stock exchange - charges a fee on each transaction, so it naturally wants that there be a large number of transactions. Hence, it needs more and more people looking to part with their capital. For which they appoint - stock brokers. Stock brokers bring people to this market. People, on the other hand, are keen to grow their wealth and are pleased to find opportunities to do so at this flea market.

- Depositories store all kinds of 'securities' (any document representing capital - includes stocks and bonds). There are only two depositories in India - National Securities Depository Ltd (NSDL) and Central Securities Depository Ltd (CDSL).

- Depositories further appoint agents called depository participants - who in turn give people access to these depositories. Hence allowing them to store their securities.

- As transactions increase, the need for one authentic record of who owns which security arises. This record (from the point of view of a company) is maintained by a Registrar and Share Transfer Agent.

- The stock exchange accounts for all transactions done at the close of the market everyday. Accounts of all brokers, and in turn the people trading through them are settled through a body called the Clearing and Settlement Corporation.

- Since so much capital changes hands in this market - even commodities want in on the action. So now, even gold, silver, aluminium, wheat, etc. are available in this market.

- In any thriving market, derivatives find their way into the mix. To keep things simple, we'll only introduce the three most common derivatives -

> Futures - Say I pay ₹1,00,00 today to buy a share of Company A which will be delivered to me one month from now. That's a futures contract.

> Call Option - If I pay, say ₹1 today, to get the right to buy 1 share of Company B for ₹20 one month from now. I may or may not go through with this purchase. This is a call option.

> Put Option - If I pay, say ₹1 today, to get the right to sell 1 share of Company C for ₹23 one month from now. I may or may not go through with this sale. This is a put option. - When a company enters the flea market to seek capital, it must abide by the stock exchange's rules. Minimum capital to be raised, approvals to be taken, and many more. A merchant banker is a professional who smoothens a company's entry into the capital market by handling of all regulations and procedures. They also arrange for the company to meet with people with large chunks of capital to deploy, so that the company feels more comfortable about finding success in the markets.

- An underwriter is someone with a lot of capital to deploy. They guarantee the company, that if all shares and/or bonds being issued by the company don't find buyers - they (the underwriters) would buy the remaining securities.

- Since the market has so many securities, it's often difficult for people to clearly identify the good ones. Research Analysts study all nuances of such securities, and make buy / sell / hold reccomendations, (often) for a fee.

- Most people are unsure about how to manage their money. Since there are so many alternatives not just within the capital markets, but also beyond it from banks (bank deposits) and insurance companies (insurance policies), it's good to get professional advice. Investment advisors give money management advice (often) for a fee.

- As the market ages, some people become experts at making good capital allocation decisions. These people get asked by many others to manage their money. Hence, mutual... funds... the funds of many people, managed by one person ⇒ called the fund manager. Mutual Funds are designed to serve the masses; through them, people of all income groups can take advantage of the capital markets. Hence, even small amounts like ₹500 can be invested into mutual funds. These funds further invest in securities (mentioned in the catalogue).

- Wealthy people always look for exclusive offerings. Be it club memberships, cars, vacations, or even with their capital deployment. Hence, Portfolio Management Services and Alternative Investment Funds provide exclusive capital offerings to wealthy individuals. The minimum capital a person needs to invest through a PMS is ₹50 Lakhs. A PMS can be of two types: discretionary - here the PMS manager individually and independently takes all capital allocation decisions. And non-discretionary - here the PMS manager makes suggestions to the client, and the client takes the final decision on capital allocation. PMS' invest in stocks or bonds.

- Alternative Investment Funds are private investment funds. These invest in pre-defined segments like - Infrastructure, Social Ventures, Private Equity, Debt, Derivatives, etc. Here, the minimum investment that an AIF can accept from a person is ₹1 Crore.

- InvITs - Infrastructure Investment Trusts are collective investment schemes which invest in large infrastructure projects like bridges, roads, towers, dams, etc.

- REITs - Real Estate Investment Trusts are collective investment schemes which pool the money of investors and invest in pre-defined real estate assets like commercial buildings, schools, etc.

- FPIs (Foreign Portfolio Investors) - When a market begins to thrive people from foreign countries vye for participation as well. The regulator makes rules for participation of FPIs in India's capital markets as well.

- Venture Capital Funds - Through these funds, investors (domestic or foreign) can invest in focused ventures in segments like - telecommunications, biotechnology, pharmaceuticals, information tectnology, etc.

- Distributers - When collective offerings like Mutual Funds, AIFs, REITs, PMS', etc are set up. Those making that offering want to increase the sum of capital they invest through the fund. And fot this they often take the help of distributers, who sell these products to their network for a commission. Though there are some good distributers as well, as a rule of thumb, it's always better to use an advisor, than to buy from a distributer. Since, the advisor is paid by you (the client), and hence has your best interest in mind. But the distributer's primary duty is to the fund whose product they distribute.

Phew! If you've made it till here, you're the real MVP!

Some Stats

- The NSE has around 1,800 companies listed on it, and the BSE has over 4,000 listed and active.

- The total equity value of all listed companies in India is over ₹150 Lakh Crores.

- The sum total of money managed by Mutual Funds in India is over ₹26 Lakh Crores.

- The sum total of transactions in one trading day on the NSE in 2019-20 averaged ~36,000 Crores in the equity and debt segment; and ~ ₹67 Lakh Crores in the Derivatives Segment. (Yes, that's a daily average.)

The regulator

The capital markets in India are regulated by the Securities and Exchange Board of India (SEBI). For each of the 24 categories mentioned above, there is a set of regulations.

Innovations

Massive strides have been made on the user experience front by players like Zerodha, Groww and CapitalMind. And, Quant Mutual Fund is bringing quant-based trading to the masses.

With direct market access being mulled over, brokers who don't provide any value-added-services to their clients could be facing a dead end.

Since, capital markets is an industry where access to the market is verily ubiqutous, major opportunities lie in:

- providing advice which is high on both - quality and integrity,

- Providing easy and delightful customer experiences in niche segments. Say for example a platform which provides exclusive coverage of IPOs (initial public offerings of shares), along with the facility to apply to them in a few clicks.

- Managing money skillfully and fairly - to provide high returns.

Conclusion

This is by far my favourite industry, and I hope this write up made it understandable for you!

The Indian capital markets have been in an exciting phase for about a decade now, and I'm looking forward to seeing how things shape up in the future.

Until next week! :)

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.