Industry101: Insurance

All you need to know to start learning about India's Insurance Industry.

Table of Contents

Hey there! Thank you for being an early supporter of STEBI - I'm very thankful for your encouragement. 😊

For long, I've felt that finance is made complicated for no reason. So I started STEBI with the goal of making it readable. To further that pursuit, today I'm launching a new section - Industry101.

Here, I'll take up one industry at a time, and simplify it for curious-beginners. You can access all such posts in one place by clicking on Industry 101 on the website menu.

We're starting with an oft-unloved, yet vital industry - Insurance. Let's dive in!

This article will flow in the following format -

- Why it exists?

- How does the industry make money?

- What does it offer?

- Who does it serve?

- What does the future look like?

- Market Leaders

- Links to other great content

- Conclusion

Why it exists?

We humans are risk takers by nature. We play sports (adventure sports even), drive, start businesses, switch jobs, some of us socialized during the height of the coronavirus too.

These risky actions can have various outcomes, with varying probabilities of transpiring. Some people drink, and drive back home every weekend. Others do it one time, and die in a car crash.

There's always uncertainty around if / when these risks will occur. But whenever, and to whoever they happen - they have a devastating impact.

It's also in our nature to protect ourselves from loss. We wear parachutes for the quintessential skydive, buy cars with airbags, save money and diversify our portfolios, and we wear masks (well, most people do).

The insurance industry is born out of our desire to safeguard ourselves from the monetary burden resulting from uncertain, dreadful events - which are natural consequences of the risks we take in our daily lives. So, let's define it -

Insurance is a transaction in which,

the Insured pays the Insurer, an amount (called premium).

As a result, the Insurer accepts to pay an agreed amount (called sum assured), if the uncertain, devastating event occurs.

An insurance policy is the document that records all this; and

payments made under this policy (from Insurer ⇒ Insured) are called claims.

How does the industry make money?

Let's take a look at their business model -

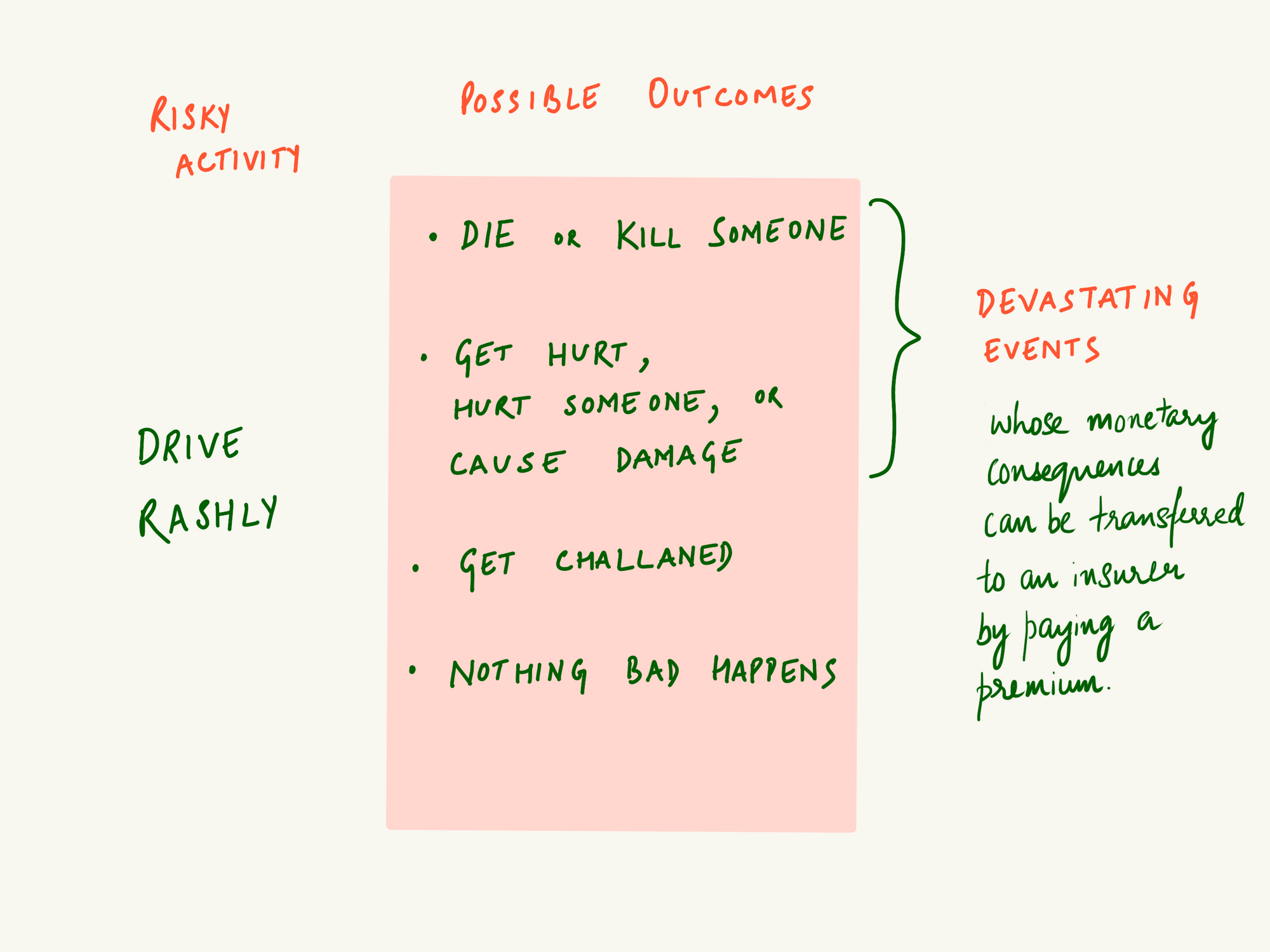

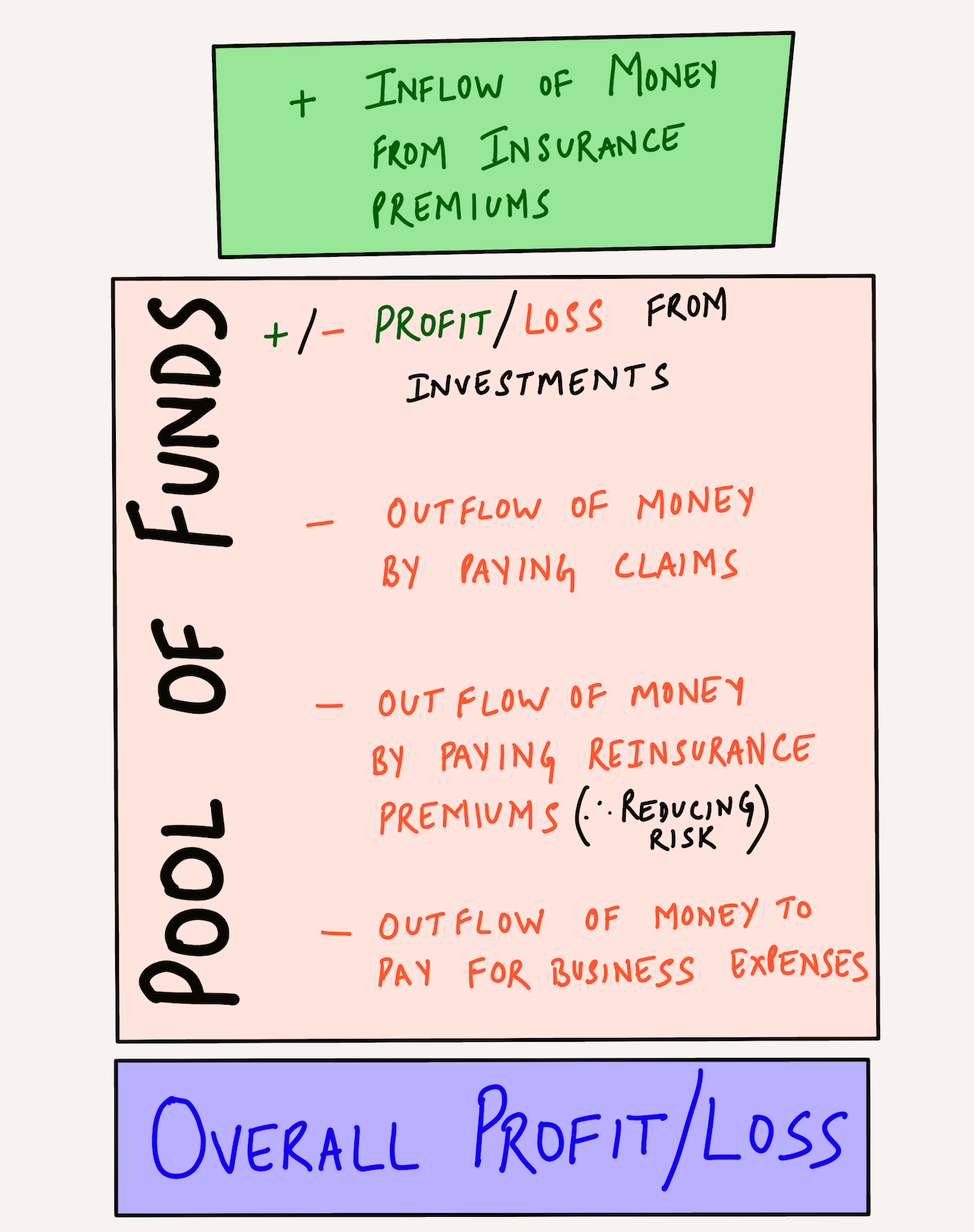

From the above chart, it becomes clear that there are five main parts of the business model that determine success or failure. Let's see them one by one -

- Inflow of money from Insurance premiums - Here, insurers carefully select and accept risks. If they sell motor insurance policies to the 100 worst drivers in the city, chances are they'll be paying far more in claims than they accept in premiums. The activity through which the insurer decides, which risks to reject, and the premium charged for accepting certain risks, is called underwriting. The better the underwriting, the better the chances of business success. The total money accumulated from collecting premiums forms a pool of funds, from which the next five activities are performed.

- Profit / Loss from investments - Since insurance in one of the few industries in which — money is received first (premium), and the costs come later (claims) — investing that money skillfully is key.

- Outflow of money by paying claims - The entire purpose of offering insurance is to pay claims. But, insurers only want to pay genuine claims not fraudulent ones. Think of the stories of people destroying their iPhones just a week before their insurance policy expired. All companies strive to identify and weeds out fraudulent claims.

- Outflow of money by paying reinsurance premiums - Generally, insurance companies tend to do well either in certain geographies, or in selling a certain product (in which they are better than the competition). This leads to concentration risk. Imagine the state of a company which sold a lot of home insurance policies in Kerala right before the recent floods. The quantum of claims could cripple the company. Hence, insurers too transfer part of their risk to larger companies (called reinsurers). This insurance for insurers is called reinsurance.

- Outflow of money to pay for business expenses - This involves office rent, employee salaries, IT spends, commissions paid to brokers and agents, etc.

What does it offer?

The insurance industry offers the public the opportunity to transfer their risks for a price. Those interested can buy personal insurances, asset insurances, or liability insurances. Sure there are many more niche products, but I've put the main ones here.

Personal Insurances

- Life Insurances - It has many types, but the main one is called Term Insurance. If the premium paying individual dies before the age mentioned in the policy, the family of the insured receives the sum assured.

- Health Insurance - This policy covers the risk of medical expenditures arising from ill health.

- Accident Insurance - Accidents are devastating. When accidents cause major damage to one's life and/or health, under this policy, the insured (or their family) receives the sum assured.

Asset Insurances

- Property Insurances - Buildings and homes, can be insured along with the furniture and other valuables.

- Stock Insurances - Businesses have many materials, semi-finished goods, and ready for delivery goods lying in their premises. These can be insured against risks like fire, flood, riots, etc.

- Vehicle Insurance - Cars, trucks, busses, two-wheelers, airplanes, ships - can be insured.

- Transit Insurance - When a business-owner sends their product from say India to South Africa, via a ship, they can buy insurance for damage cause to goods while they are in transit. (Technically, this is called marine insurance.)

- Machinery Insurance - Many kinds of machines power our economy in the 21st century. Think of boilers, transistors, conveyor belts, servers, etc. All these can be insured.

- Cash Insurance - Cash can be insured against theft by an employee or a robber. Even cash in transit (say from office to bank) can be insured.

Liability Insurances

- Product Liability and Recall - If a product causes harm to its consumers, they are likely to sue the company providing it. Those legal damages can be insured against by businesses. Further, you would've read the news about a certain car model being recalled due to a manufacturing fault. The expenses incurred by the car company to recall so many cars can also be covered in a product recall policy.

- Public Liability - Your friend went to a mall, the floor was wet and there was no warning sign saying so. He fell and hurt his back. Now he has sued the mall for damages. If the mall has a public liability policy, the insurer will pay the legal damages.

- Professional Indemnity - Nowadays, disgruntled clients are suing professionals for misconduct. More and more professionals (like doctors, architects, etc.) are buying this policy to cover the damages that might arise from such a situation. When such policies are bought by companies offering professional services, it's called 'Errors and Omissions policy'.

- Directors and Officers Liability - In large companies, every decision at the senior level has many layers of consequences. And sometimes, affected parties sue the board to recover damages. So, the D&O policy covers such damages up to the sum assured.

- Cyber Insurance - In an increasingly digital society, cyber fraud is becoming a critical threat. Cyber insurances cover the damages caused from cyber attacks.

Who does it serve?

Individuals, businesses, non-profits, governments... everyone benefits from pooling risks together.

Also, the insurance industry, through its elaborate network of brokers, agents, surveyors, loss assessors, consultants, web aggregators, etc. provides direct and indirect employment for over 20 Lakh Indians.

In a perfect insurance ecosystem - the insured behave ethically and only lodge genuine claims, and insurers manage their business efficiently - offer policies at fair prices, and offer products tailored to various parts of the society.

What does the future look like?

The future of insurance, often called InsureTech, is bright!

Like most other industries, innovation is being driven by data. Data at the distribution (insuring more risks), underwriting (more accurate pricing), and claim management (paying only genuine claims) level is spurring improvements.

- At the distribution level, digital is enabling insurers to reach more and more underserved fragments of society. Better financial literacy and niche focussed products are bringing in more people into the insurance ecosystem. Additionally micro, and bite-sized insurance products are becoming popular with younger customers.

- At the underwriting level, with access to richer data than ever before, insurers are creating more detailed risk pools which is ensuring better pricing. Further, trackers are helping insurers record bad behaviour, and identify riskier prospects, to deny or price them efficiently. This will help mitigate the old problem where everyone pays for the bad behaviour of a few.

- At the claim management level, softwares are able to identify which claims are likely to be fraudulent - flagging them for human intervention.

Market Leaders

In the Life Insurance space, the Life Insurance Corporation controls about half of the market in India. LIC is the only government owned player in this space. The three next noteworthy players are - HDFC Life, SBI Life, and ICICI Prudential.

In the General Insurance space, the government owns four companies - New India, United, National and Oriental - put together they own about 38% of the market. The three next noteworthy players are ICICI Lombard, Bajaj Allianz, and HDFC Ergo.

Links to other great content

- This is a fascinating video by the famous venture capital firm Andreessen Horowitz, explains all the changes happening in insurance, and sites various startups participating in this wave.

- This blog by Rahul Mathur does a great job of covering the happenings in the world of InsureTech. You should also check out his startup, which tells you which insurance your debit and credit cards already give you.

- For a more statistical overview of the current state of the industry in India, please check out this presentation by the Insurance Information Bureau.

Conclusion

The Insurance sector is critical for a stable and flourishing economy. But in India we are only at the end of the beginning. Here's an interesting stat - on average, an Indian pays $73 as insurance premium, whereas the world average is $650. Even if you think a realistic number for India should be a third of that, the industry can grow to three times of its current size!

My opinion is that insurance is a very exciting space for young people to explore. The incumbent players are massive, technological change on the horizon is going to be transformational, and it's all happening between now and the next twenty odd years (or less).

The take away is, if you can bring efficiencies in either distribution, underwriting, or claim management, you should dive in! If you're an incumbent, it would serve you well to learn about the disruptions happening around the world.

I hope you enjoyed Insurance Industry 101. :) If you have any suggestions for the industry I should cover next, please write to me.

Thanks for reading! Until next week!✌🏼

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.