What Can You Do About These Abysmal Interest Rates

What are interest rates? How are they determined? What avenues can a fixed deposit investor explore?

Table of Contents

I had made some fixed deposits in the May 2019, at an interest rate of 7.50%. Just 14 months later, in July 2020 if I'm to make one today, the interest rate available is just 5.35%. That's too little!

I'm sure I'm not the only one annoyed by this.

I've spent some time thinking about interest rates. You can say that, lately, my interest rate in interest rates has been very high. So, this article analyses -

- What interest rates are and what they represent

- Understanding bank rates

- Alternatives to fixed deposits

Please skip to whichever heading you want to read about by clicking on it. And if you wish to skim a section, just read the text in bold.

What Interest Rates Are And What They Represent

Wealthy people amass wealth through effort and toil (and some good fortune). If wealth could be acquired without deserving it - that would diminish the its value. And more importantly, it would diminish the value of work. Hence, wealth is a proof of work. Which is why wealth needs to be "earned".

Since earned wealth is seldom just given away - borrowing it has a price - a percentage of the amount borrowed, called "interest rate".

Now, let's get into what it represents.

For simplicity, lets call the value of money as capital, and the value of work as labour.

In a capitalistic society - the economy is an interplay between capital and labour. Capital always seeks to increase itself by using high quality labour. And labour tries to acquire a larger share of capital. Capital is used to induce labour to work, and labour is used so that capital can earn a reward.

Their interplay can have four scenarios:

- Lots of capital + Lots of labour

Here, there should be stable interest rates and a lot of economic growth. - Less capital + Lots of labour

Here, demand for capital will be much higher than its supply, and demand of labour will be much lower than its supply. So price of capital will rise and the price of labour will fall. Hence, interest rates will go up. The rich will get richer, and the poor, poorer. - Lots of capital + Less labour

Here, the demand for labour will be much higher than its supply. And the demand for capital will be much lower than its supply. So the price of labour will rise and the price of capital will fall. Hence, interest rates will fall. Labour will get a larger part of the capital pie, and wealth redistribution will happen. - Less capital + Less labour

It's impossible for a meaningful economy to exist here.

From the above it is clear, that the balance of power between the value of work (labour) and the value of money (capital) is moving in favour of the former.

Understanding Bank Rates

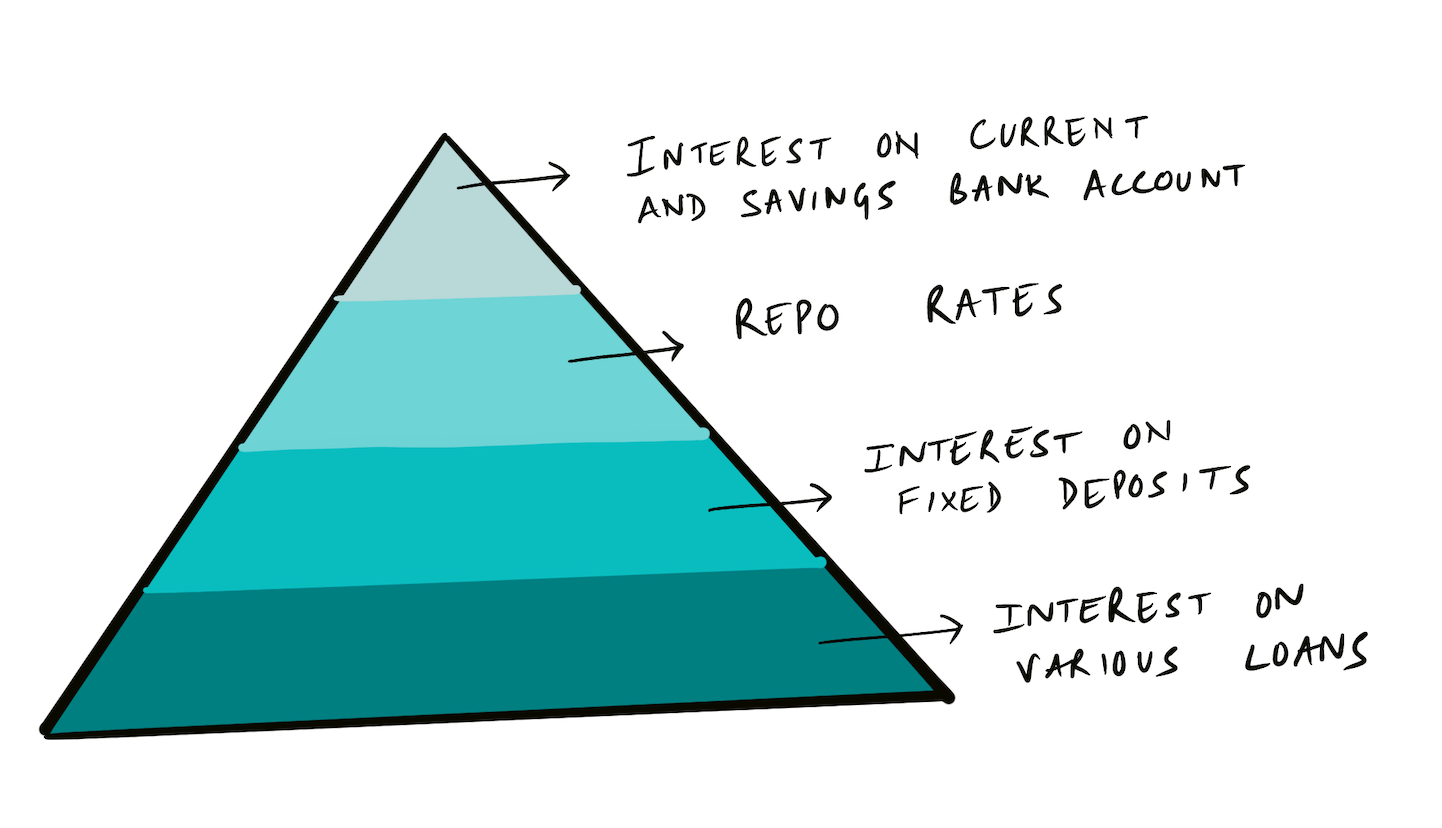

Let's think about interest rates available across different financial products like a pyramid -

Banks borrow money from the public at -

- 0% in the case of current accounts,

- at around 3.50% for savings bank accounts (considering the top banks, for other than senior citizens), and

- around 5.35% for fixed deposits (varies as per the duration of the deposit).

And lend it to governments, businesses, individuals... across products like business loans, auto loans, education loans, home loans, etc.

As per their needs, they borrow money from the Reserve Bank of India at repo rates (current repo rate is 4%). This rate is determined by the RBI. And changes in this rate affects rates across the pyramid.

Why the RBI changes the repo rate is a longer, deeper topic, which we'll delve into another time.

In wake of the coronavirus, the RBI has reduced repo rates, which in turn has reduced rates on loans - thus, encouraging governments, businesses and individuals to borrow, and then spend. This keeps the economy moving. This very move however, has reduced the interest savers earn on their deposits with banks.

Why I'm bringing this up is - just like banks find ways to earn a higher rate of interest on funds, as compared to the interest they owe on these funds - we too can do the same with a bit of effort.

Let's make peace with the rates being offered by banks, since there is nothing we can do about them. And if we seek higher returns, let's look earnestly for other avenues to invest, and take informed decisions.

Alternatives To Fixed Deposits

- Government bonds - These are government backed, and you would only lose your capital if the Government of India goes bankrupt (in which case all your rupees would be worth much less). The yield on 10 year Government Bonds today is 5.82%. That's not much, but it's better than the current fixed deposit rates.

- Bharat Bond - Think of it like a debt mutual fund, which only invests in the highest quality public sector companies like - Power Finance Corporation, National Housing Board, Indian Oil, etc. This is traded on the exchange, does not pay any periodic interest, but one should be able to earn over 6% year on year with this.

- Sovereign Gold Bonds - Gold has been doing well, and is expected to continue to do well in today's global economic scenario. SGBs allow the investor to benefit from price changes in gold, and earn an additional 2.50% interest per annum on the amount invested. I had written about gold in detail in this post.

- Corporate and Public Sector Bonds - To invest in these one needs to have a little higher level of understanding about investing. The options available to trade can be seen on the NSE website. In my opinion, one should look at the tax-free options. They are government backed, and offer a higher after-tax return than fixed deposits.

- Mutual Funds - Mutual Funds allow the investor to invest in all kinds of assets. Equities, debt, liquid funds, and so on. My friend Mannit wrote a brilliant article on how to select a good equity mutual fund, which you should check out. In my opinion, the techniques he proposes should work well for debt funds as well.

You can invest in any of the above through your broker.

For safe measure, I'm linking my disclaimer here.

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.