Active vs Passive Investing

Are Index funds really better than actively managed ones?

Table of Contents

Hi there

I’m happy to share that our previous article, a deep dive into Nippon Life India Asset Management Limited, became our most-read piece ever; and hence, our readers and subscribers have grown substantially. 🙌🏼😊

This was because Alpha Ideas, a popular investing newsletter with close to 40,000 followers on Twitter, found it on the internet, and shared it in their daily.

I’m thankful to each one of you, for your attention. It’s truly encouraging!😇

Onto today’s piece.

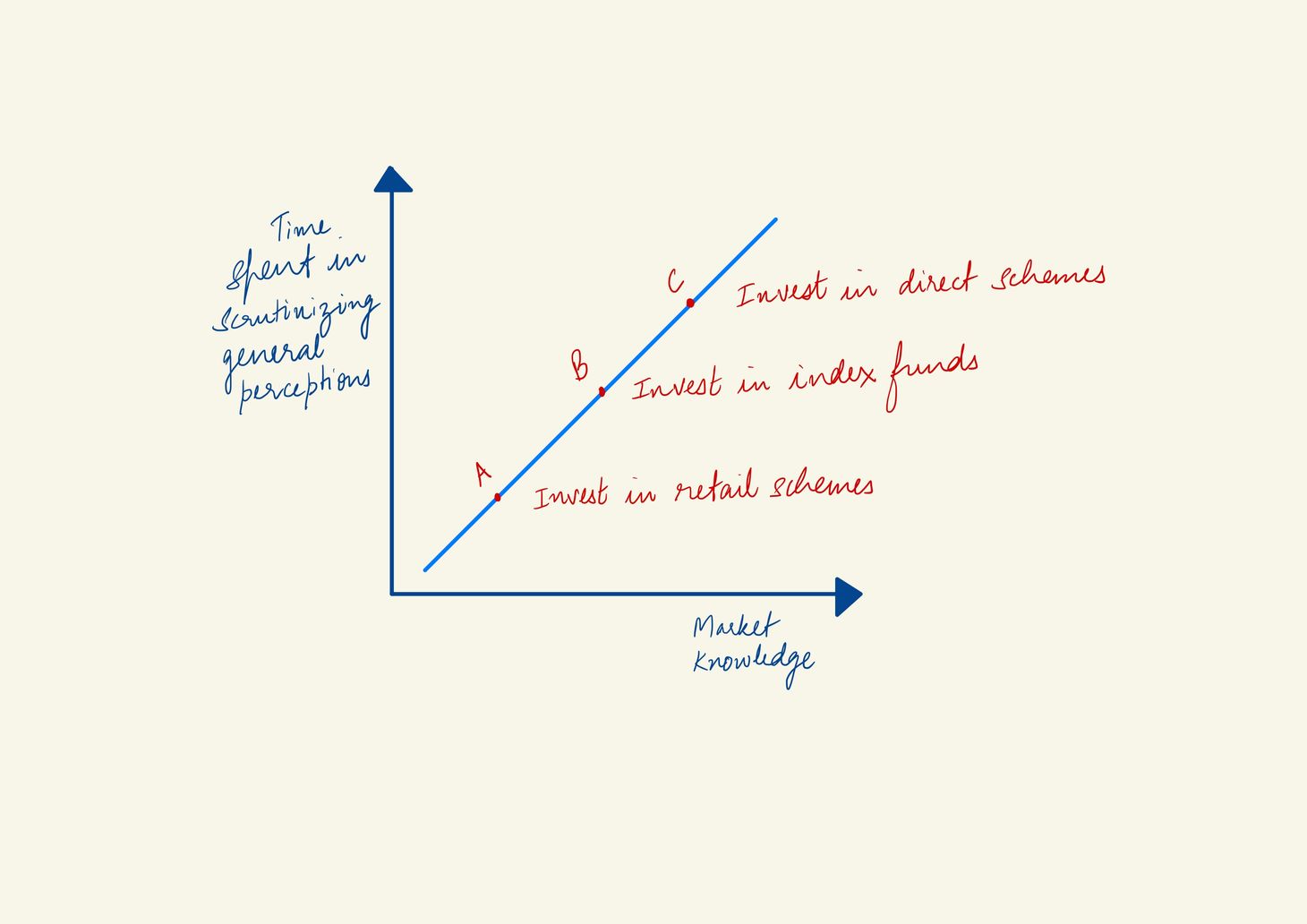

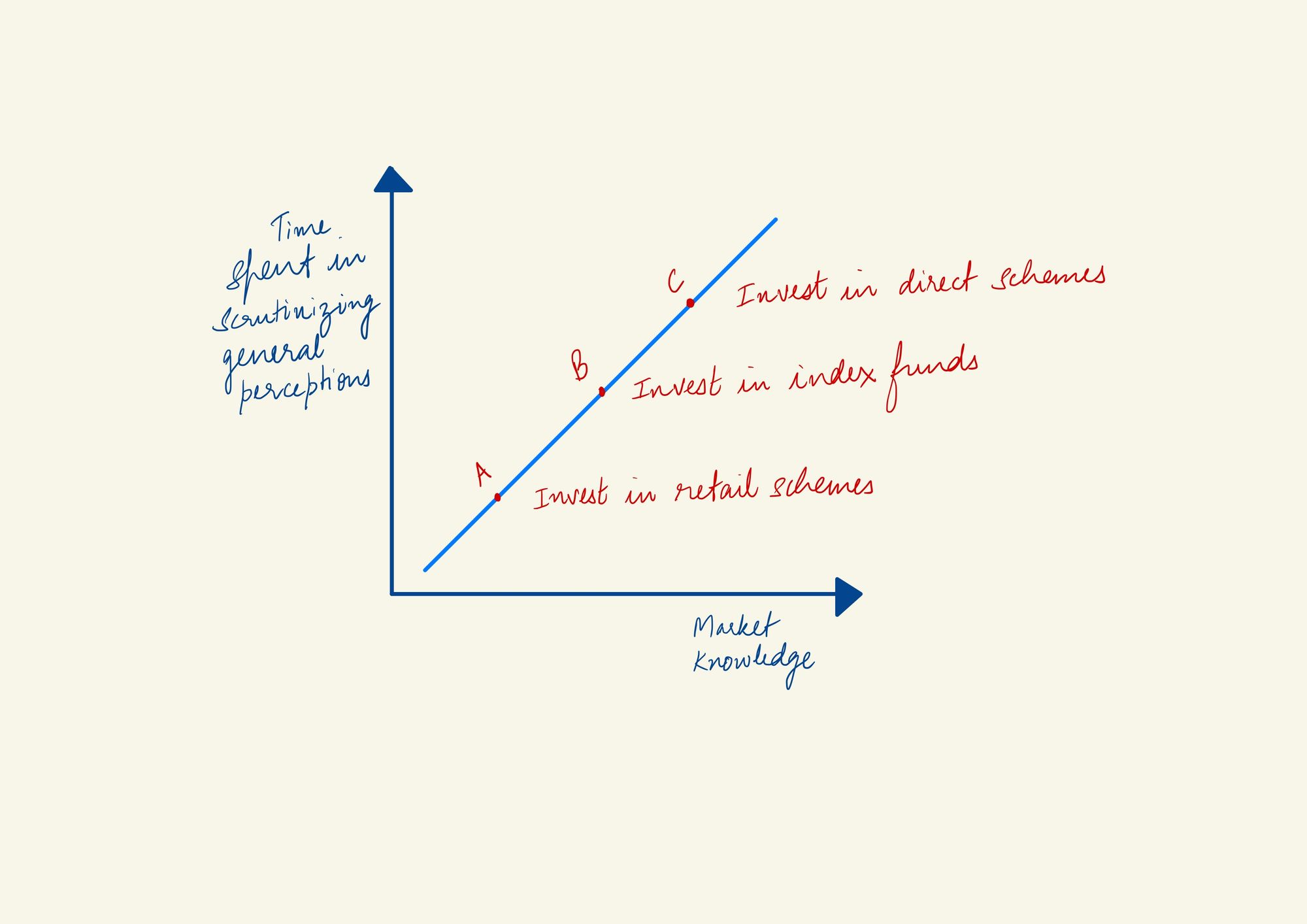

Nowadays, it’s fashionable to trash active fund management, and embrace index investing. Meaning that investors, especially younger ones, are picking index funds over actively managed mutual funds. They believe that index investing is far superior to active fund management. We wanted to scrutinise that notion. And that’s what today’s article is about.

If you’re an investor or a student of finance, this post shows you how to test commonly accepted opinions against data. And that’s what investing is all about. That’s how one really sees like an investor.

Let’s get started.

We took the total returns (inclusive of dividend) of the Nifty 50 index up to 30th June 2021, for four time periods preceding that date – 1 year, 3 years, 5 years, and 7 years. (highlighted)

Essentially, 1st July 2020 to 30th June 2021, 1st July 2018 to 30th June 2021, and so on.

We compared that to the total returns of two popular index funds (in italics ⬇️).

And also, the returns net of fees from seven top mutual fund schemes (direct funds; growth schemes), that benchmark themselves against the Nifty 50.

Here's what came up:

| CAGR till June 30th, 2021 | 1 year | 3 years | 5 years | 7 years |

|---|---|---|---|---|

| Nifty 50 | 52.00 | 15.17 | 14.85 | 12.25 |

| Nippon NiftyBees | 54.40 | 14.95 | 14.85 | 11.91 |

| HDFC Index Fund Nifty 50 | 54.16 | 14.64 | 14.62 | 11.77 |

| Axis Bluechip Fund | 47.19 | 17.08 | 17.81 | 14.91 |

| BNP Paribas Large Cap Fund | 45.41 | 16.32 | 14.39 | 13.87 |

| Kotak Bluechip Fund | 56.63 | 17.28 | 15.12 | 14.60 |

| ABSL Frontline Equity Fund | 54.24 | 13.49 | 13.23 | 12.89 |

| HSBC Large Cap Equity Fund | 48.42 | 14.02 | 14.60 | 11.79 |

| Motilal Oswal Focused 25 Fund | 48.07 | 15.32 | 16.21 | 15.71 |

| Sundaram Select Focus | 47.03 | 14.43 | 15.59 | 12.12 |

| How many Mutual Funds outperformed the better performing index fund | 1/7 | 4/7 | 4/7 | 6/7 |

Only one actively managed fund beat the (better performing) index fund in a one-year time frame. Four of seven were better in both three-year and five-year time frames. And almost all beat the index fund in a seven-year time frame.

My takeaway: In an exceptional bull market where returns are primarily generated by the largest stocks, index funds tend to outperform actively managed funds. But in the medium to long term, a high-quality fund manager usually beats the index.

Next, we took the Nifty 500 index. Again, returns in the following table are inclusive of dividends, net of fees; and all mutual funds are direct-growth schemes.

| CAGR till June 30th, 2021 | 1 year | 3 years | 5 years | 7 years |

|---|---|---|---|---|

| Nifty 500 | 58.00 | 15.01 | 15.27 | 13.07 |

| Motilal Oswal Nifty 500 Fund (started in september 2019) | 59.04 | |||

| Parag Parikh Flexi Cap Fund | 60.95 | 22.79 | 20.85 | 17.96 |

| DSP Flexi Cap Fund | 60.87 | 19.76 | 18.14 | 15.21 |

| Franklin India Flexi Cap Fund | 66.07 | 14.92 | 13.55 | 14.96 |

| HDFC Flexi Cap Fund | 65.01 | 15.29 | 14.74 | 11.92 |

| Nippon India Value Fund | 70.13 | 16.42 | 15.79 | 14.58 |

| Kotak Tax Saver | 59.83 | 18.83 | 16.98 | 16.74 |

| iPru Long Term Equity Tax Saving | 56.86 | 14.83 | 13.91 | 13.15 |

| How many Mutual Funds outperformed the index (in 1 year index fund) | 7/7 | 5/7 | 4/7 | 6/7 |

Here, across all time periods, a majority of funds beat index performance.

My takeaway: a universe of 500 stocks leaves far more room for the active fund manager to weave their magic and generate above-index returns. That is a privilege that a 50-stock-universe does not provide.

Finally, we took the Nifty 100 MidCap Index. Same pattern. Returns include dividends, are net of fees, and funds are direct-growth schemes.

| CAGR till June 30th, 2021 | 1 year | 3 years | 5 years | 7 years |

|---|---|---|---|---|

| Nifty 100 MidCap | 84.00 | 15.04 | 15.07 | 14.74 |

| Motilal Oswal MidCap 100 ETF | 82.71 | 14.67 | 14.21 | 13.35 |

| Kotak Emerging Equity Scheme | 85.53 | 21.29 | 18.97 | 21.16 |

| DSP Midcap Fund | 61.45 | 18.94 | 17.16 | 17.49 |

| HDFC Mid-Cap Opportunities Fund | 74.42 | 15.52 | 16.30 | 16.99 |

| Edelweiss Mid Cap Fund | 90.28 | 20.45 | 19.14 | 19.06 |

| L&T Mid Cap Fund | 62.73 | 13.56 | 16.50 | 17.61 |

| Sundaram Mid Cap Fund | 65.00 | 10.27 | 12.08 | 14.27 |

| Aditya Birla Sun Life Midcap Fund | 74.08 | 12.03 | 12.76 | 14.29 |

| How many Mutual Funds outperformed the index fund | 2/7 | 5/7 | 4/7 | 6/7 |

My takeaway: Again, exceptional bull markets favour index funds in the short term. But long term, capital allocation, as a skill is the clear winner.

Now, before we draw a conclusion, let's see other time periods, rather than just the period ending on 30th June 2021. Let's consider – 31st December 2020, 30th June 2020, and 31st December 2019.

Here are our findings:

| How many Mutual Funds outperformed the comparable index fund | 1 year | 3 years | 5 years | 7 years |

|---|---|---|---|---|

| Nifty 50 Funds | ||||

| Till 31st December 2020 | 5/7 | 1/7 | 4/7 | 7/7 |

| Till 30th June 2020 | 2/7 | 4/7 | 3/7 | 6/7 |

| Till 31st December 2019 | 4/7 | 5/7 | 5/7 | 7/7 |

| Nifty 500 Funds | ||||

| Till 31st December 2020 | 6/7 | 4/7 | 6/7 | 6/7 |

| Till 30th June 2020 | 3/7 | 4/7 | 4/7 | 7/7 |

| Till 31st December 2019 | 4/7 | 5/7 | 6/7 | 7/7 |

| Nifty 100 MidCap Funds | ||||

| Till 31st December 2020 | 6/7 | 3/7 | 7/7 | 7/7 |

| Till 30th June 2020 | 4/7 | 3/7 | 4/7 | 7/7 |

| Till 31st December 2019 | 7/7 | 6/7 | 7/7 | 7/7 |

Here are some things we learnt:

- We took 48 data-sets to compare the performance of actively managed funds, against that of passive funds. In 83% cases, 4 or more (out of 7) active funds beat passive funds, ie 40 out of 48 times.

- Especially during a falling / flat market, actively managed funds did far-far better than the index.

- All investing talk needs to be taken with a pinch of salt.

- We infer that the preference towards index funds is for two reasons. One, many influential investors like Warren Buffett, have spoken about the advantages of indexing. And most of us have just taken that as gospel. We need to ask ourselves whether that's true in India's context. And two, once the public learnt of the fat fee distributors were making from selling them mutual funds, they, as a knee-jerk, gravitated towards the lowest fee offerings ie Index Funds.

Conclusion

India is enjoying a massive bull market. This has many explanations. The key one though, in my opinion, is that more and more investors are participating in Indian markets every day. Currently, less than 5% of Indians have demat accounts. As more come on board, their money first would flow into large stocks, and hence purely by that trend, the 'stock market' will continue to rise.

In such a demand overpowering supply scenario – index funds will most certainly do well. But, over the long term, especially in periods when things inevitably go south, adept capital allocators will always prove their worth.

If you've gotten till here. Thanks so much for your time.😊

I hope to see you again in a couple of weeks.

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.