CompanyAnalysis: Nippon Life India Asset Management Limited

A deep dive into one of India's largest Mutual Fund houses

Table of Contents

Hi there

The last post, The Lure Of Public Money, spoke about — why IPOs come in bunches, and why SPACs are a noteworthy alternative.

Today’s post is a deep dive into Nippon Life India Asset Management Limited (NAM-INDIA) — one of India’s largest mutual fund houses.

Mutual Funds have been the financial flavour of the decade. A confluence of —financial literacy, upward market performance, and the availability of high-quality financial products — has led to a four-fold growth in India’s money management industry. If all mutual funds in India put together managed ₹100 in 2011, they manage around ₹500 in 2021.

The main participant that packages and delivers mutual funds to investors, is called an Asset Management Company (AMC). AMCs manage these funds for a fee. This fee is their income; outflows like salaries, rent, IT spends, and advertising, are their expenditure. That Income, minus the Expenditure, equals their Profit or (Loss).

NAM-INDIA is one such AMC. This article will analyse its background and business model, its financial performance and management, and finally, its stock price to articulate whether, in our opinion, it’s a bet worth taking.

If you’re an investor or a student of finance, this post would help you really see this company from an investor’s viewpoint.

Let’s get started.

Index:

1. Backstory: From Reliance To Nippon

2. The Business: Figuring It Out

- Industry (the playing field)

- Customers (those who bring demand)

- Products (what supply delivers)

- Channels (how demand and supply interact)

3. Are They Any Good?

- Strategic Performance and Future Positioning

- Financial Performance

4. Investor Friendliness

5. Pricing

6. Closing Comments

Backstory: From Reliance To Nippon

NAM-INDIA (earlier called Reliance Capital Asset Management Limited) was founded and promoted by the Reliance Group in 1995.

In 2002, they moved its head office from Ahmedabad to Jamnagar; and then moved it again in 2006 from Jamnagar to Mumbai, wherefrom the company has operated ever since.

In 2012, Reliance Capital sold 26% of the company to Nippon Life (a large life insurance company from Japan) for ₹1,450 Crores, at a company valuation of ₹5,577 Crores. It’s quite normal for insurance business groups to also have fund management businesses, for even in their core insurance business, they invest premiums received for returns. Thus, they already have both, the research team, and the distribution capabilities.

Nippon Life kept buying more shares in the company from Reliance Capital; till their stake reached 49% in 2017. In that year, the company IPO’d in October at a listing valuation of ₹15,420 Crores.

Post-IPO, Reliance Capital held 42.88% of NAM-INDIA, Nippon Life held another 42.88%, and the balance 14.24% was held by others (including retail investors).

Reliance Capital, I’ll remind you, was owned and controlled by the Anil Ambani led group which, at the time, was in financial distress. So in May 2019, they sold off their entire holding in NAM-INDIA, most of which was bought by Nippon Life. Subsequently, in late 2019, the word Reliance was dropped from the company name, and it got its current name.

Today, Nippon Life owns 74.23% of NAM-INDIA, and the company’s market capitalisation (or total equity valuation) on 3rd September 2021, was ₹25,600 Crores.

The Business: Figuring It Out

The Asset Management Industry (the playing field)

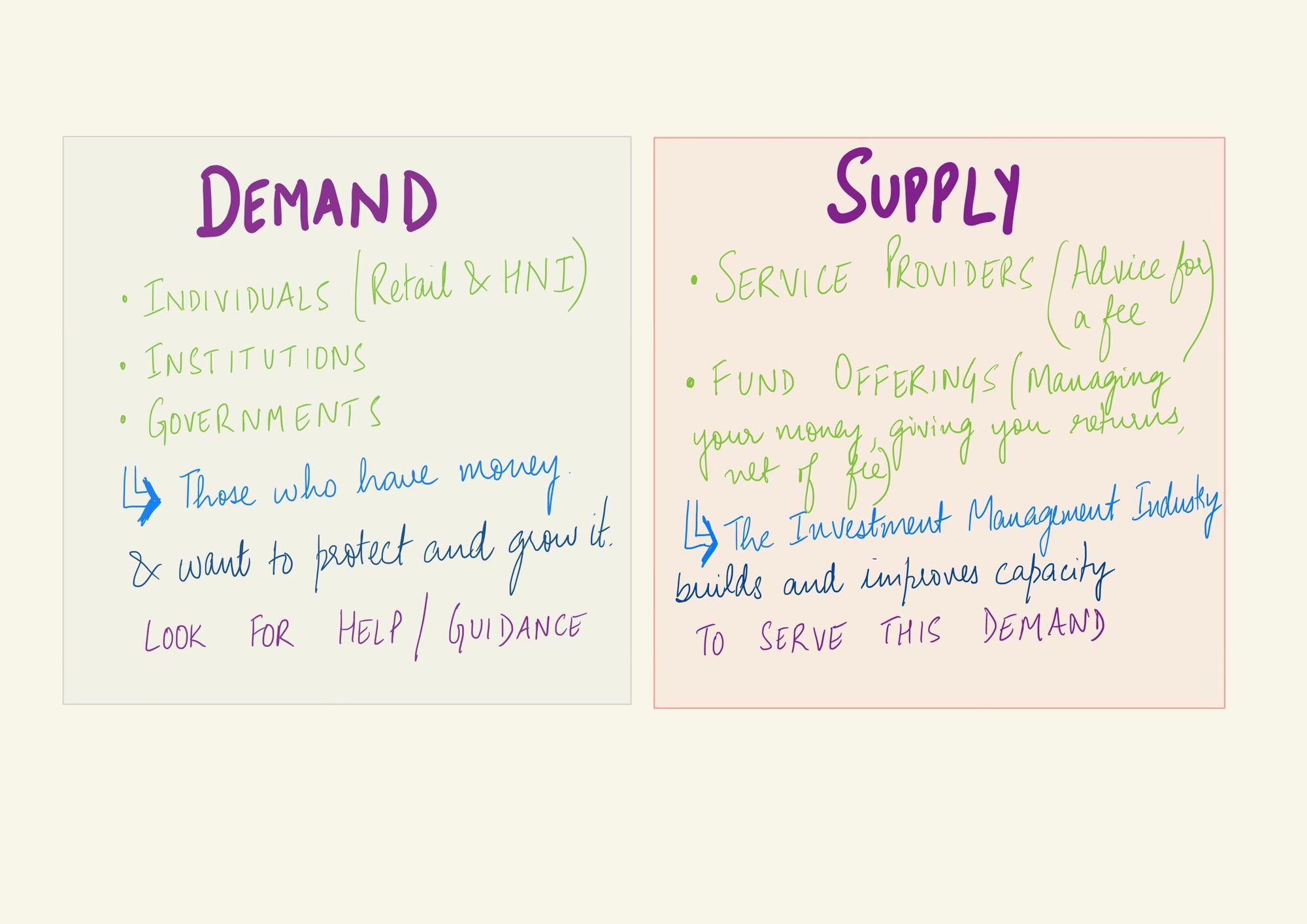

India’s asset management industry is in its heyday. The reason? A favourable interplay between demand and supply:

On the demand side,

- India’s population is young, curious, and hyper-interested in investing.

- Digital access has helped spread financial literacy.

- This has brought about the acceptance of equity, debt, and mutual funds, as alternatives to traditional favourites like gold, real estate, and bank FDs.

- This generation of independent India has more money to spend / invest than any other before it.

On the supply side,

- Our economy is getting formalised. Hence, better reporting and packaging of financial products has made investor participation easier.

- Regulations are stronger and investor-friendly.

- Taxes on investing activity… are not so bad.

- Access is easy. Usually through a hand-held-device.

- Many financial products to choose from.

Thus, Assets Under Management (AUM), ie, the total money managed by the entire mutual fund industry, have been growing at 16.4% over the last ten years and 18.8% over the last five years, pointing towards faster growth more recently. Moreover, India’s AUM to GDP ratio is ~12% whereas the world average is ~63%. Now, this doesn’t have to mean that India’s metric will climb to 60%+ as well, considering our per capita income, but, it’s reasonable to assume that it should at least double or triple in the years to come. It’s safe to conclude that India's asset management industry has a solid growth runway during the next decade or so.

The total AUM of the industry is ₹35.32 Lakh Crores (as of 31st July 2021).

Customers (those who bring demand)

Three kinds — individuals, institutions, and governments. The participation of all three has been increasing. And by the looks of it, this trend should continue.

- Individuals

- Retail investors are growing rapidly. Due to a lack of time and limited know-how, most newcomers invest through mutual funds. Currently, 10.6 Crore unique accounts invest in mutual funds. This number was 4.77 Crores just five years ago… a CAGR of 16.05%. Mind you, this number includes all kinds of accounts (not just retail). But it’s logical to assume that a bulk of them are retail accounts.

- HNIs (High Net-worth Individuals, those who have investable money exceeding ₹2 Crores) too, have been investing heavily in the markets. From the ₹32.1 Lakh Crores being managed by the mutual fund industry (on March 31st, 2021), ₹10.3 Lakh Crores was HNI money. This number was ₹4.6 Lakh Crores, just four years ago… a CAGR of 22.3%.

- Institutions like companies, investment trusts, provident funds, insurance companies, etc are a great place for AMCs to get a large corpus of funds for management. Institutions contribute 46% to the total funds managed by AMCs. The total funds contributed by institutions stand at ₹14.8 Lakh Crores… and have been growing at a four-year CAGR of 10.6%. (PS - this statistic includes contributions from governments as well, but for understanding the customer base, I prefer to mention governments separately).

- Governments, means state-owned funds to manage which, periodic mandates are given to AMCs. My view is that government participation in the mutual fund space will only increase. Funds that historically, have invested in bank FDs and government bonds, should flow more-and-more, towards market securities like equity and debt.

Currently, NAM-INDIA manages ₹1.21 Lakh Crores for Post Office Life Insurance Fund, Rural Post Office Life Insurance Fund, and Employee State Insurance Corporation. They claim to be the only private AMC in the country to ever receive such a mandate. Be that as it may, their annual report doesn’t specify their revenue from this activity. Which makes it hard to judge the value it adds to the business.

Products (what supply delivers)

NAM-INDIA deals in three investable segments, namely — equity, debt, and liquid funds. However, these are not offered to customers as is.

They are packaged in the form of — Mutual Funds, ETFs, PMS’, AIFs, or investment advice. A customer buys these.

Note:

We all know what Equity, Debt, Mutual Fund, and investment advice mean. Here’s a quick primer on the rest:

Liquid Funds are funds that make short term investments (like treasury bills and commercial papers), usually maturing in 90 odd days;

ETFs, exchange-traded funds, are nothing but mutual funds, just that they can be bought and sold on an exchange like a stock.

PMS, portfolio management service, is a personalised service where the portfolio manager invests HNIs and Institutional money into equity, debt, liquid funds, and ETFs. Mostly though, PMS’ focus on equity.

AIFs, alternative investment funds, pool money from domestic and overseas investors, to invest in off-beat assets like startups, social projects, infrastructure, or complex derivative trading strategies.

Channels (how demand and supply interact)

Though ETFs are bought directly from the stock exchanges, Mutual Funds, PMS’, and AIFs are delivered — either by the company itself, through – its staff or digital channels (the “direct” route), or through partners, both physical or digital (the “regular” route).

Recently however, these partners have started selling ”direct” offerings as well. More than anything else, this is because customers now know of the fat commissions that distributers have been enjoying at their expense.

This rings true even with NAM-INDIA. The company has paid partner commissions to the tune of ₹43.2 Crores in FY21; this is down from ₹70.5 Crores in FY20. A major reduction.

This is a growing trend around the world — since demand can easily access supply through digital channels, distributers are losing importance, and hence their commissions are shrinking. Investors now seek high-quality advisory, for a reasonable fee. (Linking here a piece I’d written on this topic.)

Going forward, in urban spaces, digital distribution would become more important, and in rural spaces, digitally-enabled partner driven distribution would be key. More on this later.

Now that we have a hang of what the business is, and how it’s conducted, let’s look at the numbers and the strategy to see if it’s any good.

Are They Any Good?

Let’s gauge this from two lenses:

- Strategic Performance and Future Positioning

- Financial Performance

Strategic Performance and Future Positioning

- AUM growth: AMCs earn a percentage of the total capital (the AUM) they manage. So, AUM growth is, in my opinion, the best indicator of whether the business is growing or not.

On that front, despite hyper-growth in the industry, NAM-INDIA has not been able to keep up. Ten years back, they were the largest AMC in the country when ranked by AUM, now, they stand at 6th.

| Rank | AUM Annual Growth Rate Over | 5 years | 10 years |

|---|---|---|---|

| MF Industry ➡️ | 18.8% | 16.4% | |

| 1 | SBI | 34.3% | 27.0% |

| 2 | HDFC | 16.7% | 16.3% |

| 3 | ICICI Prudential | 16.6% | 18.0% |

| 4 | Aditya Birla | 13.1% | 15.1% |

| 5 | Kotak Mahindra | 31.4% | 21.9% |

| 6 | Nippon India | 7.6% | 9.0% |

Even when seen segment-wise, they are unable to keep up with industry growth.

| AUM growth rate (4-year CAGR) | For MF Industry | For NAM-INDIA |

|---|---|---|

| By Asset Class ⬇️ | ||

| Equity | 22.2% | 13.3% |

| Debt | 9.2% | -9% |

| Liquid | 1.6% | -7.8% |

| ETF | 67.6% | 30.4% |

The drop was in part due to the reputation of the Anil Ambani led Reliance group, but now that promoter ownership has stabilised, the growth numbers they achieve in the next few years would truly depict their performance in a super-competitive marketplace.

-

Fees: NAM-INDIA charges, on average, 0.75% on regular schemes, and 0.38% on direct schemes. These are constantly shrinking due to regulations as well as competition. I think fee percentage is largely irrelevant when comparing AMCs. All AMCs, in the medium-to-long term, must accept the fee prevailing in the industry. And it’s hard to differentiate in this business based on fee alone. We ran some numbers, and found that the expense ratio in the MF industry are shrinking at a CAGR of ~-10.7%.

-

Investment returns: Do the company’s fund offerings perform well in their respective categories? This speaks to the quality of research, investment decision making, and of course, economic conditions. We took NAM-INDIA’s eight largest funds (by AUM), and compared their performance to their peers. Turns out, they're really good!

| NAM Fund Name | Category | 5-year CAGR | 5-year rank in Category | Top Performer Name | 5-year CAGR of Top Fund | Index 5 year CAGR |

|---|---|---|---|---|---|---|

| Nippon India Liquid Fund | Liquid | 5.99% | 6 | Franklin Liquid Fund | 6.02% | 6.06% |

| Nippon India Floating Rate Fund | Debt | 8.00% | 2 | ICICI Pru Floating Interest Fund | 8.30% | 7.82% |

| Nippon India Small Cap Fund | Small-Cap Equity | 23.14% | 2 | SBI Small Cap Fund | 23.17% | 16.63% |

| CPSE ETF | PSU ETF | 1.86% | 3 | SBI PSU | 4.29% | -1.68% |

| Nippon India Arbitrage Fund | Arbitrage | 6.22% | 1 | Kotak Emerging Arbitrage Debt | 6.04% | 6.06% |

| Nippon India Tax Saver Fund | Tax Saver | 9.48% | 33 (Last) | Axis Long Term Equity Fund | 18.59% | 16.07% |

| Nippon India Growth Fund | MidCap | 18.05% | 7 | Axis MidCap Fund | 22.01% | 14.23% |

| Nippon India Large Cap Fund | Large Cap | 14.70% | 31 (out of 39) | Mirae Asset Large Cap Fund | 17.41% | 14.64% |

-

Strength of distribution channels: Does the company do a good job of making its supply reach demand? This speaks to the efficiency of their marketing team and their business model. Here are some key points:

- the company is present at 287 locations

- has a network of around 80,000 partners, which they claim to be the highest in the industry. To compare, SBI claims to have 83,000🤷🏻♂️; HDFC 65,000+; and Kotak 15,000.

- 20+ Digital Partners (PhonePe, PayTM, ETMoney, Groww, Kuvera… to name a few).

- These distributors contribute 45% of NAM-INDIA’s AUM (48% in FY20). Which means they contribute an AUM of ~₹1,000 Crores out of a total company AUM of ₹2,218 Crores.

These point towards the fact that their reach and distribution are as good as anybody's in the industry.

-

Customer experience: Do they deliver customer delight? This speaks to whether their apps and websites are hassle-free, whether their customer support is friendly, and so on. Although there’s no airtight way to assess this, we checked their rating on mobile app stores and saw a poor showing from NAM-INDIA (ratings are out of 5):

| Fund House Name | Apple App Store | Google Play Store |

|---|---|---|

| SBI | 2.7 | 4.3 |

| HDFC | 3.1 | 3.9 |

| ICICI Prudential | 4.3 | 3.9 |

| Aditya Birla | 1.6 | 3.9 |

| Kotak Mahindra | 2.4 | 3.3 |

| Nippon India | 2.2 | 3.8 |

Strategically, the picture doesn't inspire confidence. Let’s see what the financials say.

Financial Performance

Financial statements are excellent at showing the real picture. It’s like seeing the mirror, you see it as it is.

| FY21 | FY20 | FY19 | FY18 | FY17 | |

|---|---|---|---|---|---|

| Assets | 3,392 | 2,881 | 2,776 | 2,722 | 2,245 |

| Liabilities | 292 | 288 | 206 | 292 | 215 |

| Capital Employed | 3,100 | 2,593 | 2,570 | 2,430 | 2,030 |

| Growth (year-on-year) | 19.55% | 0.89% | 5.76% | 19.70% | |

| Total Revenue | 1,419 | 1,193 | 1,650 | 1,749 | 1,435 |

| Growth (year-on-year) | 18.94% | -27.70% | -5.66% | 21.88% | |

| Operating Profit | 877 | 560 | 700 | 726 | 581 |

| Growth (year-on-year) | 56.61% | -20% | -3.58% | 24.96% |

Let’s assess some key financial parameters:

- ROCE, return on capital employed. If one starts a business with an investment of ₹100, and at the end of one year makes a pre-tax profit of ₹20, the ROCE would be 20/100 = 20%. NAM-INDIA’s ROCE (for FY21) is 33.82%. Impressive!

- FCFROCE, free cash flow return on capital employed. An excellent metric to gauge whether the business consistently recovers its receivables. But in the AMC business, recoveries are a non-issue. So here, just seeing the ROCE is enough.

- Operating Income growth, ie profit growth, is always key. The four-year CAGR here is 10.84%. Unspectacular.

I’ve assumed incomes like interest and dividend to be operating incomes only. My view is that for an AMC, these are very much a core part of their operations. Had we been looking at a manufacturing business, we wouldn’t have done so. - Liabilities to Equity Ratio. Debt to Equity ratio is popular to check for longevity risk, but the L/E ratio is an even safer measure. Liabilities represent all financial obligations of the company, and equity represents their net worth ie, their ability to pay their liabilities. For NAM-INDIA, this is just 9.4% (amazing!).

- Growth in Capital Employed (Inclusive of Dividends) - This metric is calculated by adding back the dividends paid out by the company, and computing a CAGR of growth in capital employed. The five year CAGR here is 22.93%. This means that the business itself has been growing its accounting value at around 23% year on year.

Purely on financials, NAM-INDIA has been a good business. Despite problems like erstwhile promoter reputation, and covid, they’ve comfortably stayed profitable.

Investor Friendliness

The worst businesses are those which grow their sales, but no profits flow to investors. When investing in a business, we must ensure that the management sees themselves custodians of the investor money.

The following are some indicators to check for such a culture:

- Dividends - NAM-INDIA has a practice of paying out 60-90% of profits as dividend. Though this, I would assume, delights many shareholders, in my opinion, the management should consider ways of deploying such money to increase their industry competitiveness in light of their declining market share. Superior business growth brings far more investor rewards than regular dividend payouts.

- Related Party transactions - all transactions seem to be at arm's length. In our analysis, we didn’t find any attempt to shift profits out of the company.

- Buybacks. None till now.

- Management compensation - Management compensation to Mr Sundeep Sikka, who has been CEO for over 12 years now, is ₹5.51 Crores. That of the CEO of HDFC AMC is ₹3.28 Crores. Seems a bit high. But it was ₹10.48 Crores in FY19, so it’s an improvement.

The payments to other board members seem reasonable.

Pricing

- Price to Book: 8.26. That of HDFC AMC is 13.88; and UTI AMC's is 4.61.

- Price to Earnings: 36.3. That of HDFC AMC 48.45; and UTI AMC's is 27.26.

By itself, the stock looks expensive. But based on its comparison with its only other listed peer (non-PSU), it appears to be reasonable.

Closing Comments

The AMC industry has truly had a joyride for the last two decades. And the impressive AUM growth is set to continue. How much of that NAM-INDIA will capture, is the real question. Considering they grew their AUM at 7.6% over the last 5 years, and 9% over the last 10 years. Let's assume they'll grow this AUM at ~9% yoy.

Mutual funds have now gotten commoditised. It’s hard to differentiate one from the other. Returns are similar, the fee is more or less the same, across the board. Considering that fees are shrinking at ~10.7% year on year, let's assume these shrink at 7% year on year over the next 10 years.

So, the 9% AUM growth would almost get cancelled out by the 7% fee shrinkage.

Further, over 80% of AUMs come from the thirty largest cities, and distribution in those areas is gravitating towards digital players (like Zerodha and Groww). App ratings of MF players don't help their case either. Thus, AMCs are increasingly losing control over the customer interaction layer of the business. This would deplete their stickiness with customers, while these digital partners accrue more power. This trend would hurt profit margins.

Segments like AIF, PMS, and ETFs are where the growth opportunities lie. And though the annual report does talk about their push in these, there’s nothing to evidence noteworthy growth above and beyond the competition.

Considering all the above, I’m hesitant to add this stock to my portfolio. But I would love to hear your opinion.

If you’ve gotten till here, you’re amazing! I hope you enjoyed this piece.

Thanks for your time! :)

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.