BookNotes: The Dhandho Investor by Mohnish Pabrai

Heads, I win; tails, I don’t lose much!

Table of Contents

Hi there!

Last week I wrote about, The Evolution Of Media (link to its summary). It was a relatively brief piece, which was received well. So thank you for that. :)

Here’s what I was listening to while writing today’s article; go ahead, play it in the back. :)

Today I’m sharing my notes from a famous book first published in 2007 — The Dhandho Investor, by Mohnish Pabrai. “Dhandho” is a Gujarati word that simply means “business”. Its literal meaning though, is “endeavours to create wealth.”

Mohnish is an Indian-born American, settled in Irvine, California. He’s a devoted disciple of investing icons, Warren Buffett and Charlie Munger. Having paid homage to them many a time, Mohnish often states that most of what he knows and practices comes from them. Beyond being a money manager, Mohnish is — an eloquent speaker (here’s his YouTube channel), and a committed philanthropist through an organisation he calls the Dakshana Foundation.

With that introduction, let’s get into his book.

PS: the book is full of beautiful quotes, so I’ve taken the liberty of adding them here and there.

The book has 17 chapters, but it’s easier to see them as three parts, let's call them:

Part 1: Four stories of “low-risk, high-return” business endeavours

Mohnish here sets the tone by sharing four remarkable stories which defy business school logic; and emphatically state that one needn’t undertake high risk to seek high returns. He calls this mindset — Dhandho.

Ch 1: Patel Motel Dhandho

During 1973, USA was entering a recession; as a result, many properties were on sale at relatively cheap prices. At the same time, thousands from the Patel community were kicked out from Uganda (Africa) after it came under a dictators rule. After spending decades there, a few thousand of them came to the US as refugees. They saw the motel business as a way of making a decent living, while getting free family accommodation.

The thinking of the head of the family would’ve been something like this:

“Either we work on minimum wage at $1.6 per hour, netting ~ $6,000 per year (if both elders in the family worked full time). Or with bank financing, we can buy a small motel for $50,000. Since it’s an age-old industry with a long history of cash flows, the only thing that can trash its prospects is a prolonged recession. If that happens, we would lose our down payment, and the bank would take control of the motel. We would then, worst-case-scenario, start over at minimum wage. But, if all goes well, we can pay off the bank in three to four years, while making a profit after tax of $15,000 per year.”

With this clarity of possible options and their logical outcomes, they took the plunge. The entire family would pitch in to run the hotel, thus eliminating the need for hired help. That along with meticulous hisab (accounting record), ensured that operating expenses were kept low. This give Patel Motels a low-cost advantage to its competition. Low-cost gave them the ability to offer low prices; low prices meant higher occupancy rates; higher occupancy translated into super-normal profits; and that allowed them to get more properties for expansion.

This story, according to Mohnish, exemplifies the Dhandho framework: “Heads, I win; tails, I don’t lose much!”

Ch 2: Manilal Dhandho

A similar story to the previous one, where the protagonist starts with working two jobs, then starts running a motel, and then went on to become a hotelier. The take home — work hard, save all you can, and then bet it on a single no-brainer bet. Bet meaning business opportunity, not the one in a casino. Here he closes the chapter with one of his investing mantras — “Few Bets, Big Bets, Infrequent Bets.”

Ch 3: Virgin Dhandho

We’ve all heard of Richard Branson, the founder of Virgin Group. Mohnish tells an awe-inspiring tale about how Richard started his airline business. Richard was in the music recording and distribution business; one day, he happened to receive a business plan about starting a business class airline from London to New York. After conducting some basic first-hand research by calling various airlines to get such a flight ticket, he concluded that this sector was underserved. He saw an opportunity. Instead of incurring the major capital cost of buying a Boeing jumbo jet for $200 million, he convinced Boeing to lease it to him; which they would normally do only did for major clients. He noted that he’d have to pay for fuel only 30 days after the plane landed, salaries 15 odd days later, and receive payments from booking about 20 days before the flight. With working capital requirements low, and cost of failure estimated at just $2 million — considering his music business was on track to make $12 million that year — he took the plunge.

The take-home is, if such a capital intensive business can take flight (literally) with virtually no capital, while thinking through the risks and potential downsides, then virtually any business can be started with minimal capital. One just needs to replace capital with creative solutions. Here’s a popular quote from the man himself:

“Finding something frustrating and seeing an opportunity to make it better is what entrepreneurship is all about.” - Richard Branson (not in the book)

Ch 4: Mittal Dhandho

Next, stories of how Lakshmi Mittal’s business acquisition savvy made him among the wealthiest people in the world. Two examples — one, in Kazakhstan where the government were glad to hand him the keys to the plant for nothing, for he would be saving the jobs of workers, who would later worship him for that. And two, when he acquired a plant that took over $2 billion to build for less than $220 million. The take-home? When you can pay less than value — that’s Dhandho on steroids.

Price is what you pay; value is what you get.

Part 2: The Dhandho Framework

The four real world stories, up to this point, exemplify the Dhandho philosophy of “low-risk, high reward” businesses. Mohnish now, turns his attention to educating the individual investor, and those who manage their money, on how to identify such businesses among those listed on the stock market.

Ch 5: The Dhandho Framework

... has nine principles (one per chapter), namely:

Ch 6: Dhandho 101: Invest in Existing Businesses

Stock market investors, as per Mohnish, have six key advantages over those who actually buy and sell entire businesses outside the markets.

- They don’t have to spend time in managing operations.

- They can partake in profits; while retaining full liquidity of our capital.

- Entire businesses are usually bought and sold at rational prices. But the stock market is like an auction; and the Dhandho investor can do very well by participating only when the odds are heavily in their favour.

- Buying and selling entire businesses requires a lot of capital. Stock markets allow one to start with modest capital.

- The stock market allows us to invest in thousands of businesses around the world. It’s just not possible to have access to so many businesses outside it.

- Frictional costs (costs incurred while making the transaction), are much lesser for transactions on the market, than those outside it.

Ch 7: Dhandho 102: Invest in Simple Businesses

The intrinsic value of any business is determined by the cash inflows and outflows — discounted at an appropriate interest rate — that can be expected to occur during the remaining life of a business. When there is a huge gap between the price and intrinsic value of a business, and that gap is in our favour, we can act. While discounting cash flows, be wary of making over optimistic assumptions.

The take home from this chapter is to stick to painfully simple businesses — those that are easy to understand. A good way to check for this is to write the investing thesis down in a short paragraph. If it takes more than that, it’s a problem. If it requires an Excel, that's a red flag.

Ensure that these businesses have an ultra-slow rate of change; since change is the enemy of investments. Look for mundane products that everyone needs.

Ch 8: Dhandho 201: Invest in Distressed Businesses in Distressed Industries

Here Mohnish discusses the long-standing debate between efficient market hypothesis and market inefficiencies, and concludes with the popular verdict that markets are efficient most of the time, but not all the time. And since the mood of Mr. Market vacillates between extreme fear and extreme greed, the Dhandho investor sees this as an opportunity to find distressed businesses. How can one find such businesses? The news, various publications, and websites.

One should never count on making a good sale. The purchase price should be so attractive, that even a mediocre sale gives a good result.

Ch 9: Dhandho 202: Invest in Businesses with Durable Moats

The key to investing is not in assessing how much an industry is going to affect society, or in how much it’ll grow, but in its competitive advantage over its peers, and above all the durability of that advantage.

It takes some digging to find the moat of a business; it’s also worth noting that no matter how well fortified the castle, no matter how wide and deep the moat, no matter how many sharks and piranhas in it, it will eventually fall to marauding invaders. There is no such thing as a permanent moat. We’re best off never calculating a discounted cash flow longer than 10 years, or expecting a sale in year 10 to be anything greater than 15 times cash flows at the time.

The forces of competitive destruction are so strong that, of the 50 most important companies on the NYSE, in 100+ years, all but General Electric have gone out of business.

Ch 10: Dhandho 301: Few Bets, Big Bets, Infrequent Bets

In investing, there’s no such thing as a sure bet. The wise ones bet heavily when the world offers them a compelling opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple. To be a good capital allocator, you have to think probabilistically.

The book uses the Kellys formula in many places to determine the maximum capital to be deployed in an investment. However, Mohnish has later stated in an interview that if he had to redo the book, he would completely leave out the Kelly’s formula. So, I’ve skipped getting into it. If you’re still interested to learn about it, here’s a fantastic Twitter thread on it by my friend 10-K Diver. PS: you should follow him!

Ch 11: Dhandho 302: Fixate on Arbitrage

In an arbitrage, a couple or more transactions are entered into, such that a profit is derived from the overall activity without taking on any risk. For example, if gold is trading at $600 per ounce in London, and at $610 in New York, the arbitrager buys in London and immediately sells in New York. Even large businesses have started with an idea of arbitrage, CompuLinks is one such example. The founder, Steve Shevlin’s earliest business model was to provide PC cables of various lengths and for different printers — before the primary manufacturers put them out. Just by keeping a close watch on various products on offer in the market, and being faster than the completion, they built a large business enterprise.

It’s important to recognise though that, with time, all arbitrage spreads close; and most moats vanish. But that doesn't mean we can’t invest and make a decent return. Our job is to have some perspective whether that spread will last for 10 months or 10 years. Obviously, the wider and more durable the spread, the better.

Ch 12: Dhandho 401: Margin of Safety — Always!

Mr. Buffet has often said that the concept of Margin of Safety from Benjamin Graham’s Intelligent Investor is a concept he’s used throughout his investing career. And it has served him well. What is it? When one evaluates a business to be worth X (in intrinsic value terms), and its price in the market is 0.6X. Then, 0.4X is the margin of safety.

The bigger the discount to intrinsic value, the lower the risk, and the higher the return.

Ch 13: Dhandho 402: Invest in Low-Risk, High-Uncertainty Businesses

Markets get confused between risk and uncertainty. And we can profit from this. The four stories at the start of the book, had entrepreneurs get into business which faced a wide range of possibilities for their future (i.e. high uncertainty). But there was comfort in the fact there very little capital was invested and / or the odds of a permanent loss of capital was extremely low (i.e. low risk).

There are four types of businesses :

- High risk, low uncertainty

- High risk, high uncertainty

- Low risk, high uncertainty

- Low risk, low uncertainty

The fourth combination is the one that the markets love; and these usually trade at high trading multiples. Our job is to invest in the third kind. These have the “Heads, I win; tails, I don't lose much” odds.

In the theatre called the stock market, you can only exit if someone else buys your seat — each share has to be held by someone. If there’s a mad rush to leave the theatre, what price do you think these seats will go for? The trick is to buy seats in those theatres where there is a mass exodus, and you know that there is no real fire, or it’s already well on its way to being put out. Read voraciously and wait patiently, and from time to time, amazing bets will present themselves.

Ch 14: Dhandho 403: Invest in the copycats rather than the innovators

Here Mohnish talks about the human nature of being drawn to innovation. And speaks to the merits of cloning from an investing point of view.

As per some estimates, more than half of all motels in the US are owned and operated by Patels. A remarkable stat considering that before 1970, there were virtually no Patels in America. The many Patels who got into the motel business after the first of them was successful weren’t in it for the innovation. They saw a replicable model of success and were humble enough to replicate it without trying to tweak it. Mohnish himself speaks of how he cloned Mr. Buffett’s fee structure, his practice of reinvesting his fee into the same fund, his policy of not discussing investing ideas, and keeping his team to a minimum. Large corporations like Walmart and Microsoft have been highly successful at cloning, but the trick is to execute exceptionally. When it comes to investing, cloning is the way to go.

Part 3: Additional wisdom

If you’re still with me, give yourself a pat on the back! That’s some serious commitment to the craft of investing!

Ch 15: Abhimanyu’s Dilemma — The Art of Selling

Here Mohnish draws a parallel to Abhimanyu’s story from the epic Mahabharata. Abhimanyu knew how to pierce his way into the chakravyuh (Archimedes Spiral) battle formation to neutralise the enemy, but didn’t know how to come out of it. Eventually, despite making his way to the middle and causing some damage to the enemy, he couldn’t find a way out; he succumbed to his injuries and died.

The investing lesson here is, always have an exit plan before entering an investment. A critical rule of chakravyuh traversal is that any stock that you buy, cannot be sold at a loss within two to three years of buying; unless you can say with a high degree of certainty that current intrinsic value is less than the current price the market is offering. After the price crosses intrinsic value, it's okay to sell. But Mohnish has admitted in more recent interviews that it’s best to hold the really great businesses even beyond intrinsic value, or even forever... till they stay as great businesses. Another advantage of the two to three year rule is that it forces us to think really hard about each investing idea; because we know we'll be stuck with it for 2 to 3 years.

Ch 16: To Index or Not to Index — That Is the Question

Investing through indexes is the best way to go for investors who do not want to do the heavy lifting of security analysis.

Ch 17: Arjuna’s Focus: Investing Lessons from a Great Warrior

Here Monish drills home the benefits of having a singular focus. Referring to the Mahabharata again, this time he speaks of the great archer, Arjuna. While at gurukul, many students were asked to pierce the eye of a bird with their arrow. On being asked what was in their line of sight? Everyone spoke of having a wide view, seeing a bird, a tree, the sky, and so on. Arjuna however, said that he only saw the eye of the bird. On firing the arrow, it hit the target. Investors too should study only one company at a time.

He leaves the book on a spiritual thought. After advising the reader to implement Dhandho techniques to maximise their wealth, he hopes that they’ll take the time to leave this world a better place than they found it.

I hope you enjoyed reading my notes from this wonderful book, The Dhandho Investor. If it wasn't apparent already, I’m a huge fan of Mohnish’s. I’d once written an email to him, and was thrilled to receive a reply. I should reiterate, that this post is just an effort to put together my learnings from this book; I wholeheartedly recommend reading the book to have a more detailed understanding of its concepts and philosophies (with relevant examples).

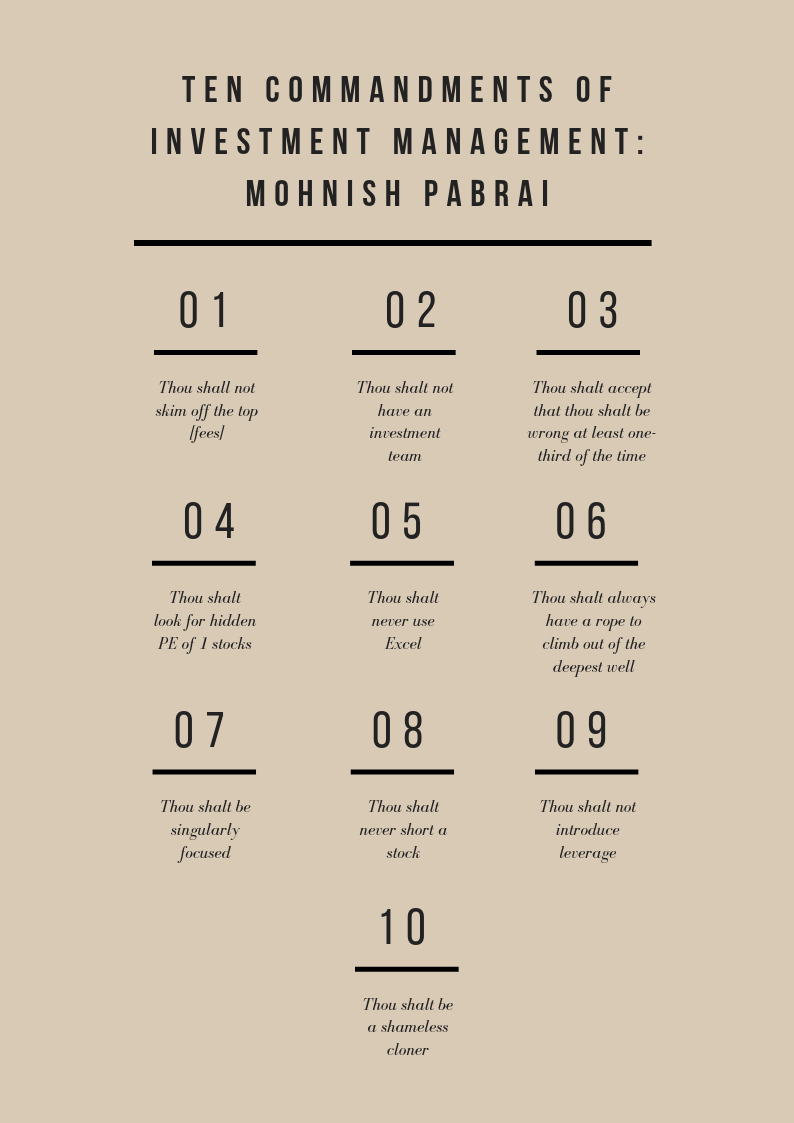

I’ll leave you with Mohnish’s famous 10 commandments of investment management. I have this poster on my office wall! :)

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.