The Holy Trinity Of Growth

The factors that make a sector the king of the economy!

Table of Contents

Hey there,

I hope you've been well. :)

This article introduces a concept that I call, ‘The Holy Trinity Of Growth’, and flows in the following format -

Though I recommend you read the full article in flow, please skip to whichever heading you want to read about by clicking on it. And if you wish to skim a section, just read the text in bold.

I hope you'll enjoy it! :)

Setting the stage

Indian Economy (right after Independence)

When India became independent, all aspects of the economy were controlled by the government through an elaborate systems of licenses and regulations, infamously called License Raj. Private players had to satisfy up to 80 government agencies before commencing production, and then, continually adhere to their regulations.

This environment created what we call, a supplier's economy, with the government playing the role of the primary controller of supply. Such an economy, doesn't give the buyers enough options to choose from. So, their demand naturally flows to the few existing (and powerful) suppliers. The result - poor customer experience.

This model was completely opposite to the economic model being followed by developed economies. Their model was broadly based on Adam Smith's seminal book - An Inquiry into the Nature and Causes of the Wealth of Nations. The key idea of which is the concept of free market, wherein he suggests that a government's role in the economy should be limited. Beyond national security, law enforcement, major public works (like roads & bridges), and universal basic schooling, the government must keep its hands off the economy. Buyers and sellers should be allowed to trade freely at a mutually agreed price. Resultantly, customers would get better products and services (at better prices), and suppliers would be forced to fall in line with consumer preferences. This would improve productivity and efficiency across society, and lead to economic growth.

So, India's economic model had to change. As the switch flipped in 1991, liberalization and globalization slowly turned an ailing supplier's economy into a promising consumer's economy; and no sector benefited (from this) like the banking sector.

An idea whose time had come

Analysing of the factors that led to a banking and financial sector revolution!

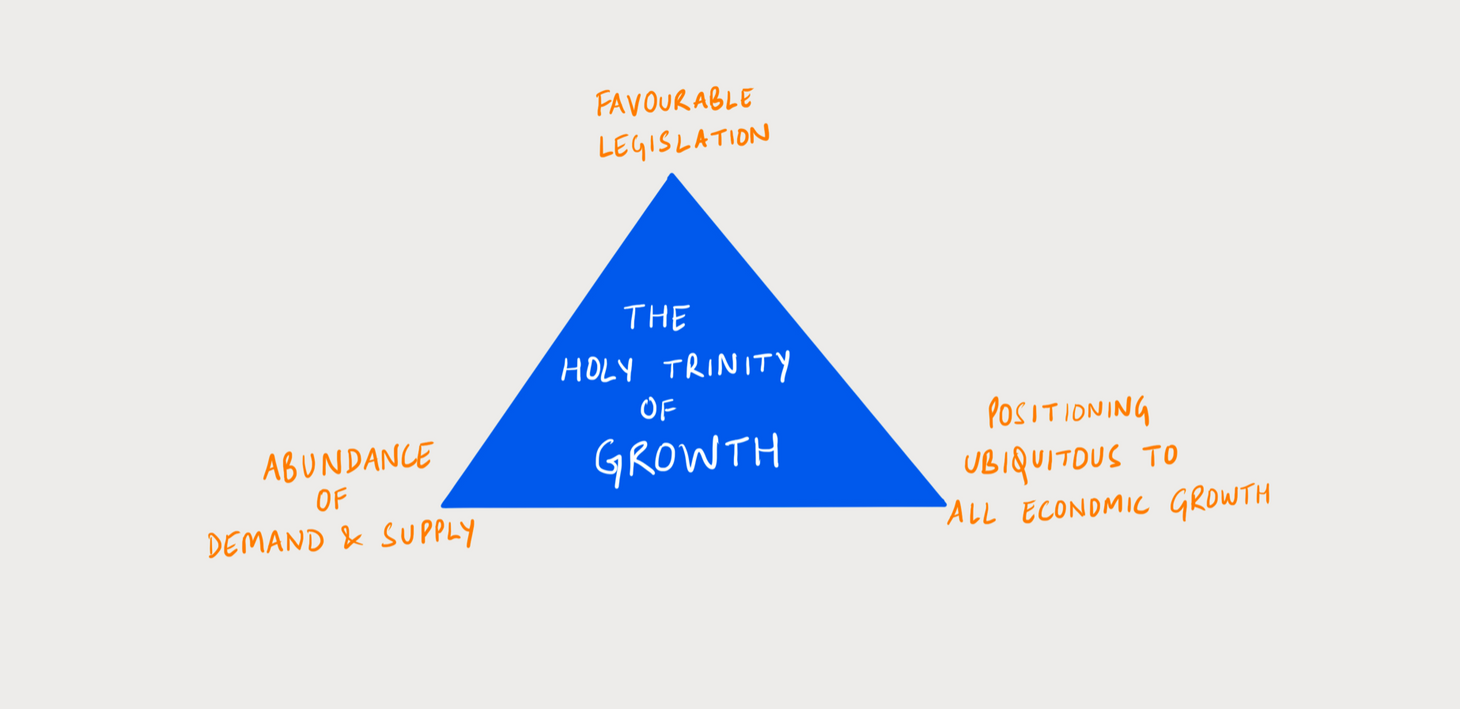

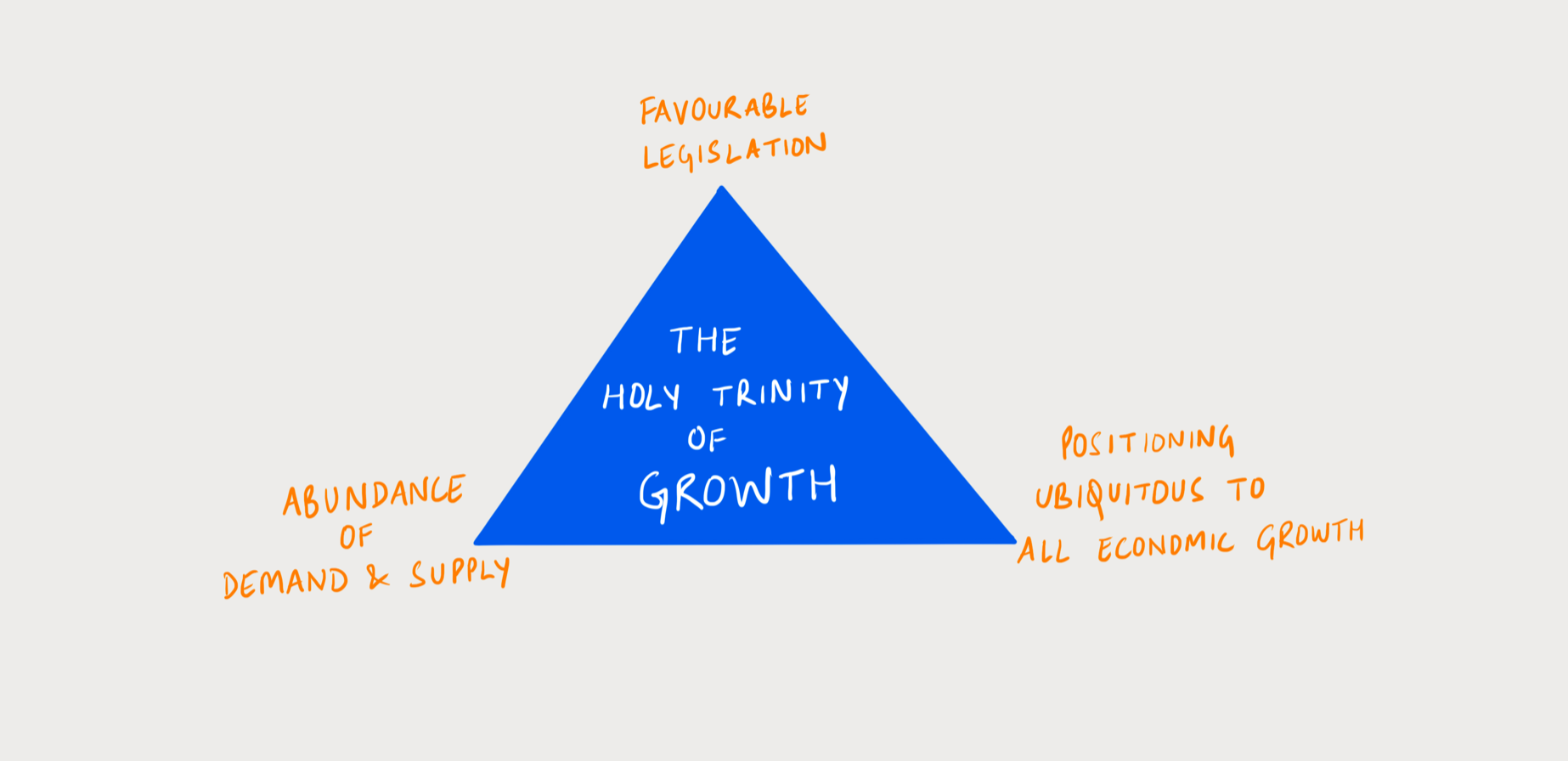

Introducing the concept of ‘The Holy Trinity Of Growth’ — for any industry to thrive to its fullest potential, three fundamental factors need to be aligned, they are -

⇒ abundance of demand and supply, favorable legislation, and positioning ubiquitous to all economic growth.

In the last 20-30 years, the financial sector benefitted from the coming together of these -

ABUNDANCE OF DEMAND AND SUPPLY

make ‘em dream; then give ‘em what they want!

During the 80’s and the 90’s, media and transportation took off in a big way. The proliferation of newspapers, television and cinema, coupled with foreign travel becoming more accessible, increased societal awareness of a world beyond India. Enamored by the richer urban lifestyles of developed countries, those who got the chance to move abroad - often did, and those who didn't (or couldn't) aspired to live similar lives in India.

Everyone's life to-do list looked something like this - move to the city, build a profitable business / get a high-paying job, buy a car, buy a house, send kids to a good school, go on foreign vacations - and talk about it. On a broader level, the talking about it served as a natural marketing channel for inducing the same desires in others.

Though incomes had been increasing, money in hand often fell short of one's dreams. Was there a way to make these dreams come true soon?

There was. Via credit.

And that's what our policy makers did.

After having nationalised 14 banks in 1969, and another 6 in 1980, Indian policy makers made a U-turn and handed out 10 private banking licenses in 1993-94 and another 2 in 2003-04. This privatization brought about efficiencies, and improved customer service.

To a generation brimming with dreams... credit was irresistible. Home loans, auto loans, personal loans, business loans, credit cards... borrow from the future to fulfill your dreams today!

This created a tsunami of growth for the financial sector. Credit became the key enabler of every major purchase made by society. Domestic credit grew at an average of 15.2% year on year, between March 2000 and March 2020. So if total loans given in India added up to ₹ 100 in the year 2000, that number reached a staggering ₹1,700 in March 2020. By comparison, during this time, India's GDP only grew at an average 6.5% year on year; a growth from ₹100 in March 2000, to ₹350 in March 2020.

FAVOURABLE LEGISLATION

when policy agenda meets the need of the hour!

Every government wants two things - soaring economic growth, and high tax collections.

Increased lending usually brings about economic growth, so, governments often encourage banks to lend. As long as no major banking collapse happens, this strategy tends to prevail in modern economies.

Alongside, realising that bringing economic transactions into the banking system made them traceable (and hence taxable), policy makers constantly took measures to bring all economic transactions into the banking system. Another shot in the arm for the financial sector.

BECOME UBIQUITOUS TO ECONOMIC GROWTH

Money, the means through which all economic activity happens, is monopolised by the banking and financial sector. If you spend money it goes to the seller's bank. If you don't, you keep it in your bank (which they further lend).

If manufacturing does well ⇒ banks prosper.

If housing does well ⇒ banks prosper.

If the auto sector does well ⇒ again, banks prosper.

It isn't often that ‘The Holy Trinity of Growth’ comes together for any industry. For banking however, it did. This has made the financial sector grow in prominence over the last 20 years; and stocks of the top players in the space have given remarkable returns to investors.

But now, the times have changed. There's a new kid on the block.

Time for the next idea

Just like many factors came together to make way for extensive banking growth, many trends have been knitting together to facilitate a massive boom in information technology. Many think the boom has already happened (well relatively yes, since 7 of the most valuable 10 companies in the world are technology companies), but considering its potential, we're just getting started.

Let's assess where technology stands with respect to ‘The Holy Trinity of Growth’ -

ABUNDANCE OF DEMAND AND SUPPLY

a big fat, YES!

Let's start with demand -

- Indians are currently the world's largest per capita consumers of mobile data. And that graph is only trending upwards.

- More and more industries are starting to use data in their day to day operations. Generating and consuming more data than ever before.

- And about half of India's population is yet to come online; and my guess is their thirst for data will be huge.

So, without question, insatiable demand is definitely there.

And, supply -

To answer that, one just needs to look at what India's most powerful businessman, Mukesh Ambani is doing. Jio promises to make data available to every Indian, and giant strides have already been made.

The reach and the quality of cellular data has improved significantly. Further, to serve those at the base of the economic pyramid, India now has the cheapest data plans in the world.

So, supply has caught up for the most part, and is pushing forward day by day.

FAVORABLE LEGISLATION

Let's recollect, what are the two things every government wants? - Soaring economic growth, and high tax collections.

Realising that economic growth could be unlocked by vastly improving ease of doing business, the government has started using tech to turn the corner.

To combat Red-tapism, physical interactions between society and government officials are being reduced. This is being done through - faceless e-assessment for taxpayers, digital filing of all compliances, and direct benefit transfers.

Further, everyone from farmers, students, startups, professionals, government officials are being encouraged to use technology in their day-to-day tasks. Also, notice that the government has launched many apps on mobile app stores. (Imagine that!)

Though there are some concerns around major technology players being foreign owned and controlled, it's good to see measures being taken to partner with them. Fundamental issues around data privacy (who should have access to a user data) and net neutrality (the internet should be the same for everyone, and not curated to the geography, device, etc.), I'm afraid, come intertwined with the data revolution. Just like bad loans come intertwined with credit growth. Regulators have the challenging task of keeping technology companies in check, without diluting customer experience.

To sum up, legislation is favourable towards technology adoption.

BECOME UBIQUITOUS TO ECONOMIC GROWTH

Every organ of society — from manufacturing, services, education, government, legal, etc. — now realises that it's more efficient to create, store, communicate, and process digital information, than physical information.

Education is morphing into into EdTech. Banking into digital banking. Then there is E-governance, BioTech, FinTech, InsureTech, AgriTech, PropTech...

Data is the new fuel that is powering every sector of the economy to its next phase. And digital is the medium through which data is expressing itself.

Through its charecteristic of being useful to every kind of economic activity, data has become omnipresent in the new economy.

Just one look at the apps on our phone tells us that so much of our lives are now digital. Our letter-box, calendar, notebook, files to store documents, music player, camera, newspaper, to name a few - have become digital. And I'm sure more will follow.

Strata's of society that haven't had opportunities available to them, will benefit the most from information access. To illustrate - better access to a world beyond their physical surroundings will ensure bigger dreams, bigger dreams will propel human effort, human effort will bring about prosperity, prosperity will improve lifestyles, this will increase consumption, that will further boost the economy.

The holy trinity of growth is firmly in place! Information technology will permeate more and more into our lives with each passing day.

Thanks for reading. :)

I would love to know your thoughts on this topic. Do connect with me on Twitter or LinkedIn.

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.