The Lure Of Public Money

Why does anyone IPO, and what’s so special about now?

Table of Contents

Hi there!

Long time, no read. I’m sorry, my bad 🙋🏻♂️

After a six-month hiatus, Stebi is back. Though, in a slightly tweaked avatar.

What’s changed?

In this second innings, I’ll publish an article every other week (instead of weekly). This should help me improve quality 👌🏼, get at least 7 hours of sleep every day 😴, and do justice to my day job 👨🏻💼

What stays the same?

Stebi will continue to provide a clear, calm, and high-road-ish perspective on business and finance.

Onto today’s piece — you must’ve noticed that this year, all of a sudden, everyone wants to do an IPO (Initial Public Offer). Popular names include Zomato, Paytm, Oyo, Policy Bazaar, Nykaa and GoAir. It’s natural to ask why anyone IPOs, and what’s so special about now?

Today’s article will dive into that (and much more). I hope you’ll enjoy it. (Here’s some delightful background music to help with that).

Index :

Why is everyone IPOing?

The short answer is — because investor money is (easily) available.

To elaborate — an unprecedented amount of capital (both domestic and foreign) is vying to invest in India.

Domestically, stock markets are growing in popularity; especially among the youth. In the last 10 years, the number of Demat accounts has grown at more than 11% year-on-year. In FY21, that number (from FY20) grew by ~35%.

Foreign investors' participation in India is also on the rise. Here’s a mind-boggling statistic — foreign investors pumped in more than ₹1.4 trillion in the Indian stock market in 2020.

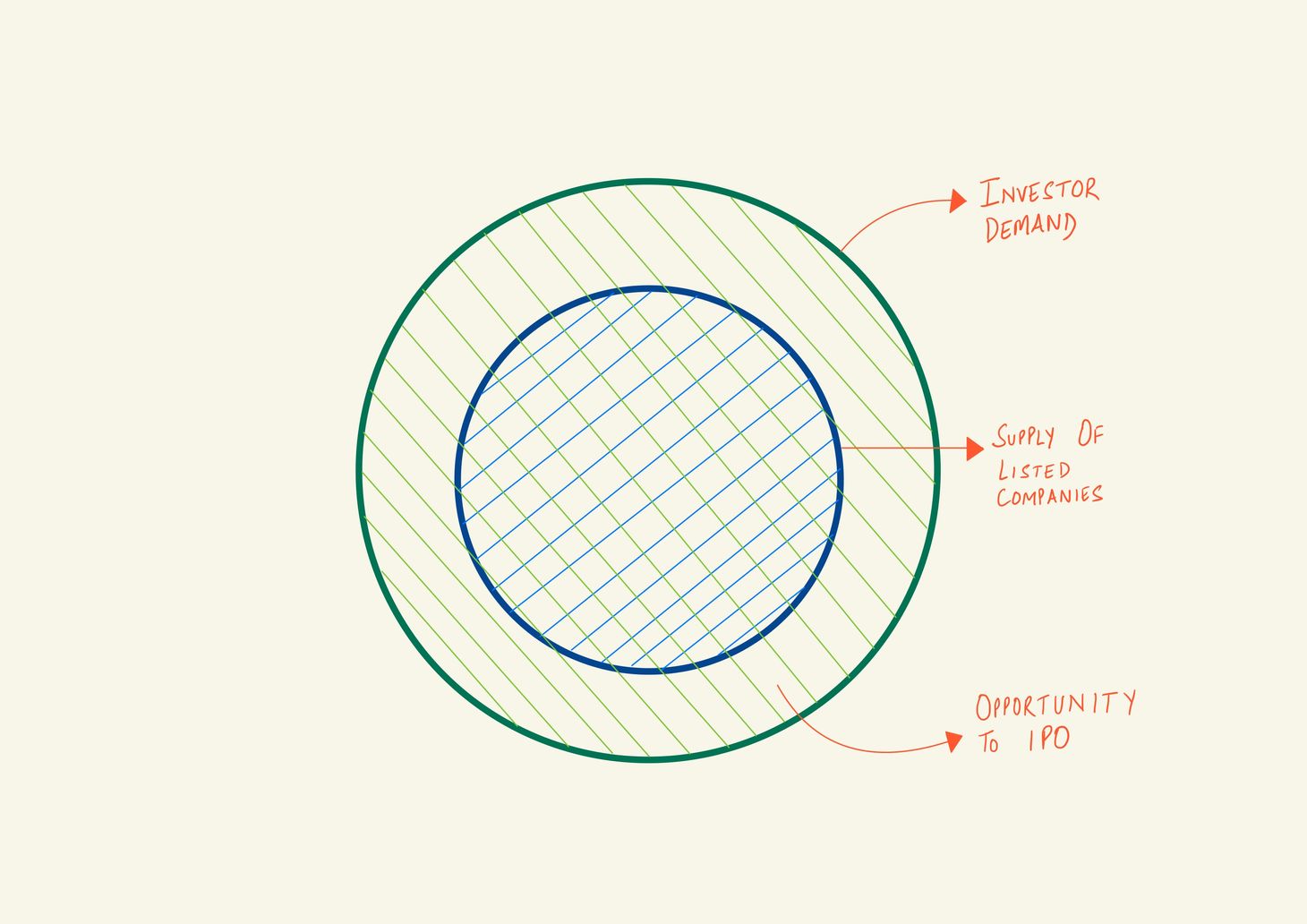

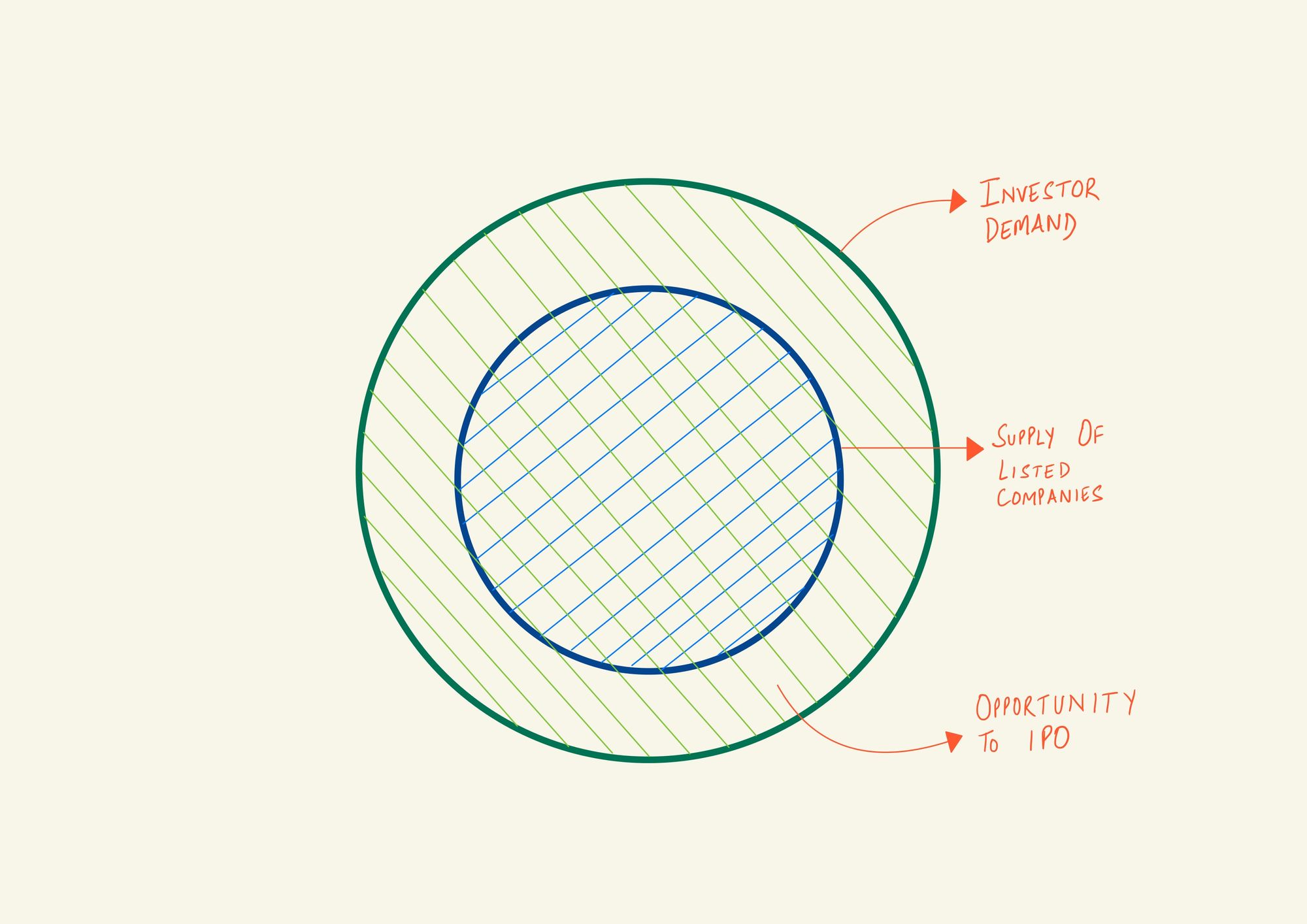

These numbers prove that the demand for Indian, publicly traded companies is sky-high. Resulting in inflated valuations of traded stocks.

This presents a fantastic opportunity for unlisted companies to IPO at high valuations. Make hay while the sun shines, right?

Demand > Supply ⇒ Valuations rise ⇒ IPOs raise more money for every unit of equity diluted.

Seeing such times, many companies prepone their IPO plans; this time too, we’re seeing that happen. More capital was raised through IPOs in FY21, than in the preceding two financial years combined. And going by the first four months' data (of FY22), we’re on track to grow that already massive number by 50% (this year).

Supply is stepping up to meet Demand.

One might think, when raising money from venture capitalists and private funds (access to capital) is easier than it’s ever been, what’s the need to IPO and list on a stock exchange?

The key reasons are:

- Visibility among the broader public: When more and more people become shareholders, they become evangelists of the business in society. And that brings in more business.

- Strict listing regulations add credibility: In India, all publicly listed companies are regulated by the Securities and Exchange Board of India (SEBI)(no, the name Stebi isn’t inspired by them). In the eyes of investors and the public, generally, a listed company adhering to those regulations is more trustworthy than others.

- Exit opportunity for and making liquidity available to — early investors and employees holding stock options: Once shares start trading on an exchange, their price is available for all to see. This allows holders of this equity to sell a part of their holding as per their convenience and need. This is much harder when the shares are unlisted and only bulk deals are possible.

But IPOs have their problems as well:

- High Costs: The process of listing is long, onerous, and expensive; it involves — documentation, approvals, compliance, investor-road-shows, and more. Beyond this upfront cost, the constant cost of compliance (filings, disclosures, reports, etc.) is high as well.

- Business management becomes complex: With increased investor scrutiny, managements can become shortsighted to ensure the stock price remains high. At an extreme, this can lure them into accounting frauds. Plus, increased compliance can slow down management decisions.

- Uncertainty around the listing price: Despite spending months prepping for their IPO, a management doesn’t know what price they’ll list at, until the last day. Moreover, a listing can be mispriced. Say a stock lists at ₹60 per share, and within a couple of weeks, it skyrockets to ₹120 per share. It means that the company could have listed at at-least ₹100 per share, and taken in the additional money raised into the business while diluting the same amount of equity.

We live in rapidly changing times, and there are new ways to do everything. And there is an alternative to the traditional IPO which has come back into focus over the last few years… it’s called a SPAC. Here’s a primer.

SPAC — Another way to IPO

A SPAC is a Special Purpose Acquisition Company.

What does that mean?

Easier through a story, right? Let’s bring Bani back. The founder of BakerBani.

Quick recap: In an earlier article on business strategy, I had introduced a character called Bani. She starts and grows a baking business to capitalise on an opportunity she spots in the hill-station hospitality industry. The article talks about idea, proof-of-concept, growth, competition, and strategies to improve and strengthen a business.

BakerBani has now grown into a pan-India brand. Venture capitalists who invested in BakerBani, have made excellent returns. Business revenues and profits have been growing at 20% year-on-year, for over 15 years. The latest funding round valued it at ₹5,000 Crores.

She’s been working on a new line of healthy, gluten-free cereal. To do a countrywide launch, she needs to raise ₹500 Crores. Although she always planned to go public sometime in the future, considering the extensive investor demand in the market, her advisors are telling her that the time is now. Her options are:

- Spend 6-9 months with investment bankers to prepare for an IPO. This would include an enormous amount of documentation and scrutiny from SEBI. Still, she would not know until the very last day how much BakerBani is listing at, and as a result, how much money she’s raising for her business.

- Negotiate the price with a SPAC, close all documentation in 3-4 months, and De-SPAC.

She’s never heard of SPACs before. She speaks to a few bankers, and does some reading. Her learnings are:

- A SPAC is an empty company created by a lead investor called a sponsor.

- The sponsor invites people to invest in their SPAC. These people make their investment decision based on the reputation and track record of the sponsor.

- SPACs list on a stock exchange from day one. Since the company has no operations (just a big bank account), regulatory approvals take less time as compared to a traditional IPO.

- The objective of the SPAC is to find a target company (one that actually runs a business, like BakerBani) to merge with.

- Investors of the SPAC vote, whether or not to merge with a proposed target.

- If approved, the target has to pass some regulatory checks.

- And through this merger, called the De-SPAC, the target company gets to list on a stock exchange.

- If the SPAC is unable to merge with a company within 2 years, the sponsor winds up the company, and refunds the investors their money.

In short, by choosing a SPAC — Bani would know exactly how much money she is raising for the equity she dilutes, it would take half the time, and she could get an excellent investor on her side. The downside — higher costs as compared to IPO, and a shorter time to learn the ropes of being a publicly listed company (ie, handling compliances, investor relations, etc.).

SPACs are all the rage in the US. Indian regulators are discussing it, they’ve even floated a consultation paper, but there’s nothing concrete as of now. Only time would tell whether they see the light of day in India. If they do, we would surely do a more in-depth analysis.

How to see as an investor

Investing during these times of inflated investor demand is hard. One does feel enticed by a shiny new IPO, but it's not always worth investing in.

IPOs are cause for celebration — since they point toward entrepreneurial success, and the company's willingness to share its internal working with the larger public, which in turn leads to the public partaking in that growth. But even though most list at a gain during such times, investors must stay vigilant.

It’s okay to lose out and an IPO. It’s also okay to love a company and abstain from applying for its IPO. Because one can always buy it later, when the valuation is saner.

Remember — every business has a past (that you can study) and every investment has a future (good or bad, depends on your study and the decision it propels).

I hope you enjoyed this piece. Do write to me with feedback.

I’m really excited about Stebi’s second innings, and hope to add some financial perspective to your lives. :)

See you soon!

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.