SBI Card: The More, The Merrier

A look into the business of India's second largest credit card issuer!

Table of Contents

Hi there!👋🏻

For every 100 people in India, there are 4 credit cards. Compare that to — 331 in the US, 105 in Brazil, 92 in the UK, and 53 in China; there’s much room for growth.

But, considering the ancient Indian ethos of eschewing debt, along with competition from UPI technology — the road ahead has challenges.

Today’s topic is SBI Cards & Payment Services Limited (SBICARD); the company that issues all SBI branded credit cards. With 19% market share, they’re second only to HDFC.

While analysing SBICARD, we’ll discuss — the card and payments ecosystem, the company’s business model, their financial performance and management, and finally, their stock price — to articulate whether, in our opinion, it’s a bet worth taking.

Let’s get started.

Index:

1. Backstory

2. The Business

- Card Payment Ecosystem

- Industry

- Customers

- Products

- Geography

3. Are They Any Good?

- Financially

- Strategically

4. Does The Management Have Integrity?

5. Pricing

6. Closing Comments

Backstory

In May 1998, State Bank of India and GE Capital floated a joint venture to offer “world-class payment products and services” to Indian customers.

With SBI’s brand name and distribution network, and GE’s backend technology and processing capability, the venture held immense promise. And deliver they did. They became the 2nd largest card issuer by 2006, and touched 50 Lakh cards in force in 2017. (That number is 1.3 Crores, as of December 2021.)

In 2017 though, in line with their global strategy of exiting financial businesses, GE Capital sold their stake. Post which, SBI held 74%, and Carlyle group, a large international Private Equity investor, scooped up the remaining 26%. This transaction happened at a valuation of ₹8,224 Crores.

In March 2020, SBICARD became the first (and only) credit card issuer to list on India’s stock exchanges. Here’s a snapsot of their shareholding pattern:

| Shareholding Pattern | Post-IPO | Current |

|---|---|---|

| SBI Shareholding | 69.5% | 69.5% |

| Carlyle Shareholding | 15.9% | 3.1% |

| Other Institutional Investors | 7.9% | 22.9% |

| Non-Institutional Investors | 6.7% | 4.5% |

| Market Value of Company (in Crores) | ₹70,900 | ₹80,600 |

Data (rounded off) as per the latest disclosures.

Now, what do they do for a living? Let’s find out.

The Business

Card Payment Ecosystem

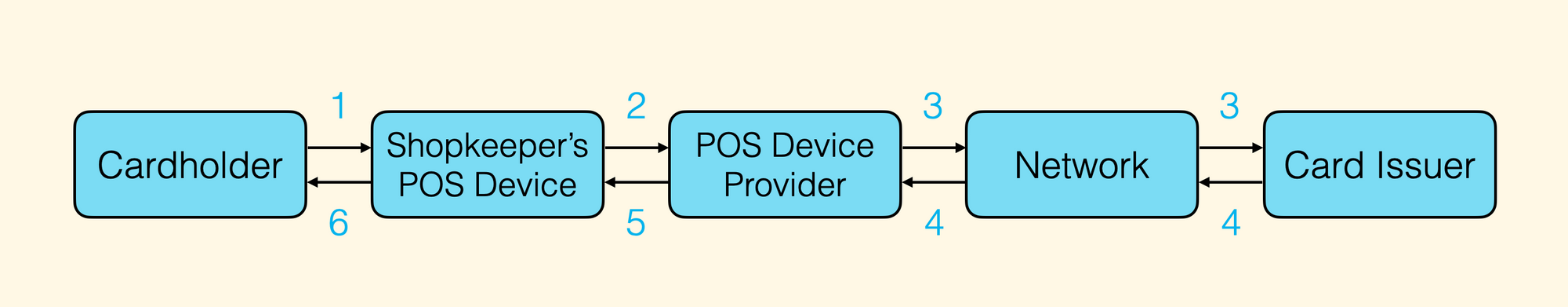

We’ll start by understanding how each credit card transaction happens:

For simplicity, in this example, the customer is using an SBI credit card, and the shopkeeper is using an ICICI Bank POS device.

- To pay for a product, the cardholder swipes an SBI credit card on an ICICI POS Device. (POS = Point Of Sale)

- The device encrypts the customer’s SBI Card data, and sends it to ICICI Bank.

- ICICI Bank further sends this data, through a credit card network like Visa or Mastercard, to SBI for authentication.

- SBI authenticates the details, checks credit limit, and approves or declines the transaction. It then sends this information back to ICICI, through the Network.

- ICICI now, through the POS Device, notifies the Shopkeeper whether the transaction has cleared or been declined.

- The Cardholder can now remove their card, and take a receipt.

Notice that ⇒ A transaction between the customer🙋🏻♀️ and the shopkeeper👨🏻💼, also involves — the card issuer1️⃣, the POS provider2️⃣, and the network3️⃣. And they all wish to be compensated for their services. Say this transaction is of ₹100, anything between ₹1.5 and ₹4 is shared between 1️⃣,2️⃣,&3️⃣. The rest accrues to the shopkeeper👨🏻💼.

Industry

India’s move from an almost-only-cash, to a less-cash economy is in full swing. And the credit card industry is a major beneficiary. It’s hard to say no to interest free credit for upto 40 days.

Here’s some data:

| Credit Card Industry (CY21) | Industry | HDFC Bank | SBI Bank | ICICI Bank |

|---|---|---|---|---|

| No. of Credit Cards (in Lakh) | 689.49 | 158.36 | 131.61 | 123.54 |

| % Market Share | 100.00% | 22.97% | 19.09% | 17.92% |

| 3 Year CAGR | 15.96% | 8.98% | 20.48% | 26.94% |

| Transactional Value (₹ Crore) | 8,90,946 | 2,43,540 | 1,68,531 | 1,70,474 |

| % Market Share | 100.00% | 27.33% | 18.92% | 19.13% |

| 3 Year CAGR | 16.35% | 15.17% | 21.36% | 39.12% |

| No. of PoS Machines (in Lakh) | 54.98 | 10.11 | 8.21 | 8.51 |

| % Market Share | 100.00% | 18.38% | 14.94% | 15.48% |

| 3 Year CAGR | 15.21% | 31.27% | 12.47% | 32.01% |

This clearly depicts the surge in card payments, and hence stellar growth in this industry.

PS: Growth in the number of POS devices is one of the metrics that depict a surge in this ecosystem. That, however, is not SBICARD’s business. A different company, wholly owned by the bank, issues SBI branded POS devices.

Customers

SBICARD’s customers fall under two broad categories — Retail & Corporate. Retail dominates the overall numbers (clocks in more than 3x of corporate spends), but, per client earnings are higher on the corporate side.

A general rule of thumb is — more the affluence, the more the benefits.

One would assume that SBICARD just serves SBI’s customers, but that’s not true. Over half their new card customers from non-SBI sources.

Products

The credit card business is all about customer acquisition… it’s about who can issue the most cards, to the highest spending customers.

To achieve this volume, participants:

- Use fancy names like, elite, advantage, premium, and luxury to attract customers.

- They target specific segments of society, like doctors. Exclusivity!

- They issue co-branded cards to capture the customers of other brands. For example, SBI partners with travel brands like Air India, Vistara, Yatra, ITCTC and Etihad; and with mass brands like Tata, OLA, Apollo, and Bharat Petroleum.

- They further have banking partnerships with Allahabad Bank, Karnataka Bank, South Indian Bank, Karur Vysya Bank, and Bank of Maharashtra.

Further, to keep customers glued, all credit card companies try to match each other’s products. Standard offerings include — loyalty points, entry into airport lounges, ATM cash withdrawal, business loans, and EMI based retail purchases.

Geography

Though SBI only issues cards in India, one can use their SBI card to make payments internationally.

Are They Any Good?

In this section, we’ll look at financial numbers to see how good the business has been. And next, we’ll study their strategic positioning for the future.

Financially

Balance Sheet numbers depict SBICARD’s financial muscle, and how they’ve grown over the years.

Growth rates across all the below metrics are healthy. The one anomaly is the 6.74% YoY growth in Balance Sheet size. That, in my opinion, is Covid effect. The fact that, in the 9 months of FY22, they’ve already grown their balance sheet by 18.9% is impressive. Further, they’ve reduced GNPA and NNPA from March21 to December21 — from 4.99% to 2.4%, and from 1.15% to 0.83% respectively.

| ₹ in Crores | 3-Year CAGR | FY21 | FY20 | FY19 | FY18 |

|---|---|---|---|---|---|

| Net Worth | 38.87% | 6,302 | 5,341 | 3,588 | 2,353 |

| YoY Change | 17.99% | 48.87% | 52.47% | - | |

| Outside Liquidity | 21.89% | 17,820 | 15,561 | 12,427 | 9,841 |

| YoY Change | 14.52% | 25.22% | 26.28% | - | |

| Total Funds Used | 25.53% | 24,122 | 20,902 | 16,014 | 12,194 |

| YoY Change | 15.41% | 30.52% | 31.33% | - | |

| Total Balance Sheet Size | 22.26% | 27,013 | 25,307 | 20,146 | 14,783 |

| YoY Change | 6.74% | 25.62% | 36.28% | - |

From the Income Statement, we’ve learnt that 55% of operating revenue comes from the revolvers. Considering transactors are usually 4x of revolvers, 20% customers contribute 55% income.🤯

First, transactors — who enjoy interest free credit, and pay it off in full on the due date. From these customers, credit card companies earn only fee income. That too indirectly, as it flows to them from the point of sale.

Second, revolvers — those who seldom pay full dues, and practically “live on credit”. These customers, in addition to generating indirect fee income on transactions, pay interest on the credit they use. Hence, they generate more revenue for credit card companies.

SBICARD’s Operating Profit is ranging from 13% to 17% of Operating Revenue. That said, in the 9 months of FY22, they’ve already matched FY21 Profit Before Tax.

| ₹ in Crores | FY21 | FY20 | FY19 |

|---|---|---|---|

| Interest Income + Past Recoveries | 5,326 | 5,145 | 3,829 |

| Fees Income | 3,908 | 3,979 | 3,072 |

| Other Operating Income | 442 | 456 | 351 |

| Revenue From Operations | 9,675 | 9,580 | 7,252 |

| Impairment Losses & Bad Debts | 2,639 | 1,940 | 1,148 |

| Finance Costs | 1,043 | 1,301 | 1,009 |

| Cost of Doing Business | 4,646 | 4,781 | 3,795 |

| Net Loss / (Gain) on fair value changes | 612 | 1 | -0.1 |

| Operating Profit | 1,286 | 1,557 | 1,301 |

| Other Income | 38 | 172 | 34 |

| Profit Before Tax | 1,324 | 1,730 | 1,335 |

| Tax Expense | 339 | 485 | 470 |

| Profit After Tax | 985 | 1,245 | 865 |

| Other Comprehensive Income | 13 | -3 | -3 |

To conclude, they have a strong financial position, and are earning good profits.

Strategically

This is my favourite section. Here, we understand how a business has positioned itself for the future. We’ll see for competition, for risks, for strengths, and so on.

Concentration Risk

In FY20, their 20 largest clients accounted for 0.48% of all advances. That number in FY21 has come down to 0.2%. Excellent! There’s nothing worse than a lending business with concentration risk.

NPA Management

As mentioned above, they’re doing a good job of at NPA Management. Considering SBI’s years of learnings, the process power around running this business is extremely valuable.

Customer Delight

SBICARD’s mobile app has a 4.6-star rating on Apple’s App store, and 4.4 on Google Play Store. Good stuff!

Impact of UPI

This is the big one, UPI is a mobile payments system that has taken India’s payments ecosystem by storm. Here’s some data:

| No of Transactions in Lakh | FY21 | FY20 | FY19 | FY18 | FY17 |

|---|---|---|---|---|---|

| UPI | 2,23,307 | 1,25,186 | 53,534 | 9,152 | 179 |

| YoY | 78.38% | 133.84% | 484.94% | 5012.85% | - |

| Credit Cards | 17,716 | 21,982 | 17,724 | 14,130 | 10,935 |

| YoY | -19.41% | 24.02% | 25.44% | 29.22% | - |

The number of UPI transactions from FY17 to FY21 have grown 311x. While credit card transactions have just grown 1.62x (Even though that by itself is a respectable 12.8% four-year CAGR.)

| Transactions in ₹ Crore | FY21 | FY20 | FY19 | FY18 | FY17 |

|---|---|---|---|---|---|

| UPI | 41,03,653 | 21,31,760 | 8,76,970 | 1,09,832 | 6,947 |

| YoY | 92.50% | 143.08% | 698.46% | 1481.00% | - |

| Credit Cards | 6,33,298 | 5,77,649 | 6,07,946 | 4,62,633 | 3,31,221 |

| YoY | 9.63% | -4.98% | 31.41% | 39.67% | - |

UPI transactions are already 6.5x of all credit card transactions. And, they carry zero transaction charge! From the payment recipient’s standpoint, UPI is absolutely better than credit cards. UPI payments reflect in their bank immediately, whereas credit card payments take 24-48 hours.

Despite this, I believe that credit cards have a decent place in our economy’s future; even a decade hence. Sure, percentage transaction fees must reduce, but the core business would, in my opinion, have a strong decade.

Hypothetically, if all shopkeepers come together to revolt against credit card companies taking say 2% cut of their revenue, everyone “could” move to UPI. But the demand for credit is as old as humanity’s existence. And where there is demand, supply appears. It might have a new name and form, but this rule is undefeated.

So strategically, despite UPI, and Fintech’s gaining ground, SBICARD’s is well positioned to thrive.

Does The Management Have Integrity

In this section, we look for red flags🚩: outrageous management compensation, biased dividend policies, illogical buybacks, and shoddy related party transactions:

- Even their highest-paid employee received ₹ 1.75 Crores during the year. Reasonable given the size of the company. The new MD & CEO, Rama Mohan Rao Amara, joined on 30th January 2021. So during FY21, he just received ₹ 11 Lakhs, which is quite low for the position. All clear on the remunerations front.

- The company has paid just the one dividend in May 2020 of ₹1 per share. The amount seems fine. The timing is odd. This was when the country was in lockdown 1. All lending businesses were worried about recoveries. Maybe, they just wanted to give the stock price a boost after a poor IPO🤷🏻♂️.

- No buybacks yet.

- Considering SBICARD works like a sister concern of State Bank of India, Related Party Transactions are significant. The risk of profit shifting from one entity to another can never be ruled out. But, it’s a package deal. Investor’s cannot enjoy growth in large part due to SBI’s brand and network, but evade this risk.

Pricing

I ran some basic math with conservative assumptions; let’s walk through it:

- In CY21, the Industry’s credit card spends equalled ₹8.9 Lakh Crores. These have been growing at a 3-year CAGR of 16.35%. Assuming that, that number will grow at 15% for the first 5 years, and 10% for the next 5 years. We get 28.83 Lakh Crores — a ballpark figure industry credit card spends in CY31.

- SBI’s current market share (in industry spends) is 18.92%, and they’ve been growing it at a 3-year CAGR of 21.36%. Let’s assume their market share will mature at around 20%. With that, SBICARD’s share of spends would be 5.77 Lakh Crores.

- When we divide their fee income by spends processed, we get 2.3%. Assuming that that transaction charge % reduces to half — at 1.15%, their fee income would be ₹ 6,636 Crores.

- Though 55% of revenue comes from interest, let’s just double their fee income to arrive at ballpark total revenue in CY31 ⇒ ₹ 13,272 Crores.

- At a standard 15% profitability, we’ll get ₹ 1,991 Crores as Operating Income.

- Assuming RBI rates to stay the same or go down, an earning multiple of 30 is acceptable. That gives us a CY31 market cap of ₹ 59,730 Crores.

- This is less than today’s market cap of ₹ 80,600 Crores.

I can conclude that based on these assumptions, to my eyes, the stock is too expensive.

Closing Comments

Considering everything we have studied, SBICARD is a wonderful business! They’re in a growing industry, serving a rapidly growing demographic, with one of the best brands possible.

That said, it’s hard for me to recommend the stock at today’s price. Obviously, I could be wrong. But, I’d much rather tread conservatively, than be overoptimistic and risk losing capital. And for those reasons, I’m out!😎

I hope you enjoyed reading this analysis. Thanks so much for your time!

Share this on: WhatsApp | LinkedIn | Twitter.

Enjoying Stebi?

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.