Hey Bank! How do you do?

Storytelling our way through the business of banking. Covering - what a bank does, how to gauge whether it's doing well, how and why it is regulated, and the future it's staring at.

Table of Contents

Hey there,

I hope you enjoyed last week's article about BakerBani - The life story of a business.

Quick request - Help me spread the word about STEBI by sharing an article you like on social media. :)

This week, we're going to story-tell our way through the business of banking. We'll cover what a bank does, how to gauge whether it's doing well, how and why it is regulated, and the future it's staring at.

Let's get to it.

What is a bank?

Let's bring back our lead character - last time baker, this time banker - Bani.

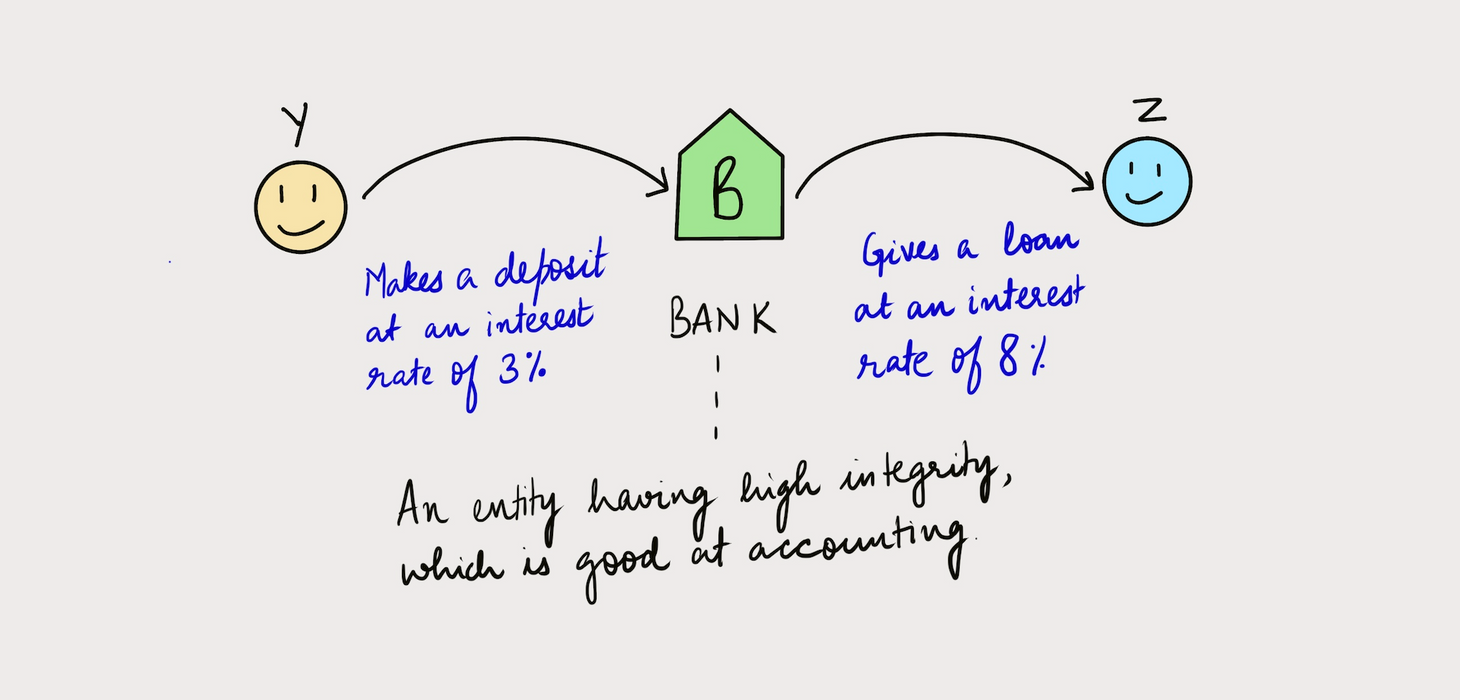

Bani is reputed to have high integrity; and she's always been good at accounting. She lives in a small community of about 100 households.

One day, the business-owners and elders of the community, decide that Bani is the ideal candidate to serve as a trustee of funds. Her job would involve -

- keeping money safe,

- maintaining precise records, and

- lending to community-members based on the merits of each case.

She accepts the responsibility, and hence, Bani's Bank is born!

On her first day at the office, Y makes a deposit of ₹100. The bank promises them an interest of 3% for the year. On the 365th day, Bani's Bank would owe Y ⇒ ₹100 of the principal and ₹3 as interest. Total, ₹103.

At the same time, Z applies to Bani's Bank for a loan of ₹100. She sanctions it at an interest of 8% per annum.

On the 365th day, Z pays Bani's Bank, ₹100 of the principal and ₹8 as interest. Total, ₹108.

After paying Y the ₹103 owed, the bank has made a profit of ₹5 (i.e. ₹108 - ₹103).

This profit is used to meet expenses like - rent, operational costs, employee salaries, office supplies, etc. If you've ever wondered why lending rates are always higher than the rate you get on your deposits, this is the reason. The difference is used by the bank to meet its expenses.

To summarize, the business of a bank is to accept deposits and give out loans, and use the difference in the interest rates to pay for its expenses.

Two key terms to check if a bank is doing well

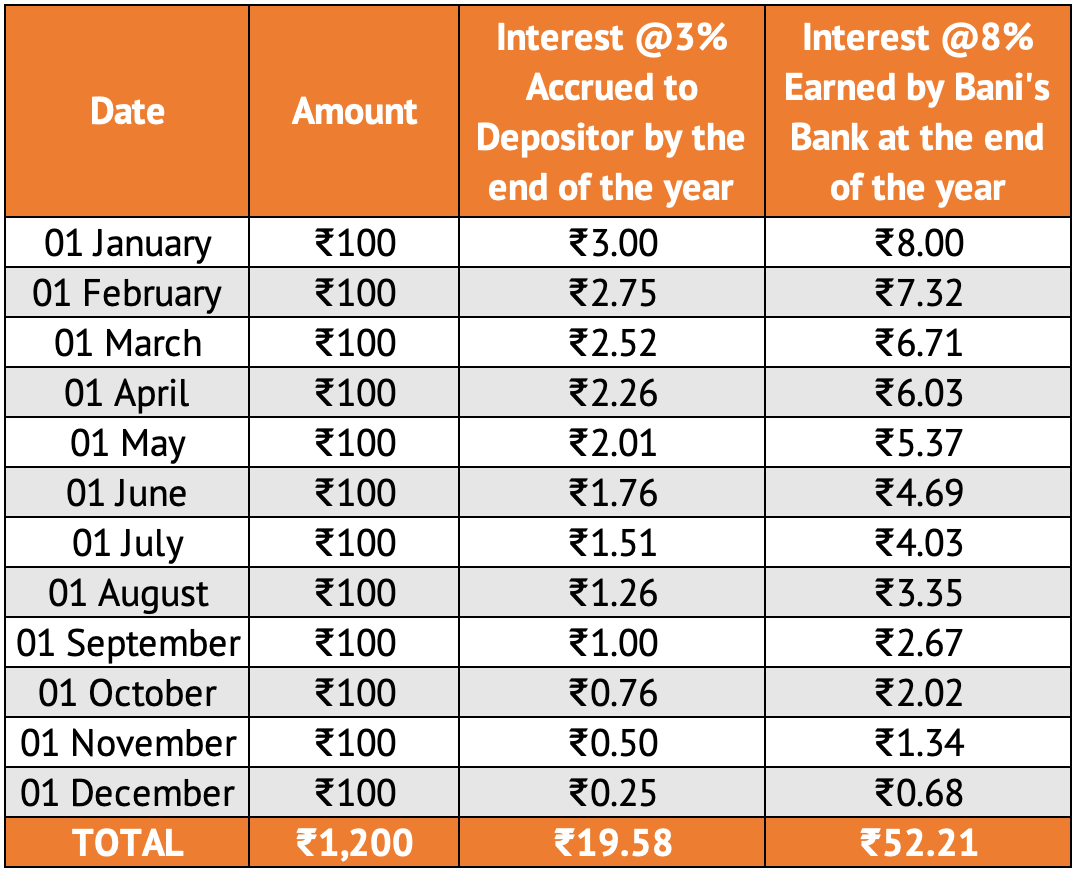

Say, throughout the year, on the 1st of every month, one person comes in and makes a deposit of ₹100, and another borrows ₹100. And no other deposits or loans were made in the year.

At the end of the year (31st December), the bank will calculate interest using the following formula :

Interest = (Principal x Rate x Time)/100

In our example, Principal is always ₹100. Rate is either 3% (for deposits) or 8% (for loans). Time is 1 for the deposit made on 1st January, since the year has come to a close. But, for the deposit made on 1st February, at the close of the year, only 11 months have passed. So in our formula, 'Time' will be 11/12.

Hence, the interest amounts calculated through this formula will be as follows.

Now, as on 31st December, Bani's Bank is serving as a trustee of client's money, which adds up to ₹1,200. This amount is called - Assets Under Management or AUM. The sum total of client funds held by the bank.

And Bani's Bank has earned interest income of ₹32.63 (i.e. ₹52.21 - ₹19.58), through its core business of accepting deposits and giving loans. This is called Net Interest Margin or NIM. Usually expressed as a percentage of average assets i.e. (assets at the start of the year + assets at the end of the year)/2.

⇒ Bani's Bank's Average Assets = (0 + 1200)/2 = 600

⇒ Bani's Bank's NIM = (32.63/600) x 100 = 5.44% (approx.)

The AUM and NIM help measure just how well (or poorly) a bank is doing. For some perspective (as on 31st March 2020) :

- State Bank of India had an AUM of ~3.74 Lakh Crores, with a NIM of 3.18%.

- HDFC Bank had an AUM of ~59 Thousand Crores, with a NIM of 4.3%.

- RBL Bank (a smaller bank) had an AUM of 2,350 Crores, with a NIM of 4.56%.

Alternative Revenue Streams

Bani's Bank is making a healthy Net Interest Margin of 5.44%, but she can further add to the bank's revenue through the following channels -

- Fee based services - The bank can earn fees on a host of services like - lockers, mobile alerts, credit card facility fee, cheque processing fee, paper statement fee, etc. Further, by setting-up channels like - wealth management (managing clients money to earn returns) and investment banking (raising funds from the market, or buying / selling of companies), the bank can really spruce up its revenues.

- Treasury Operations - The bank can invest the funds it holds in various financial instruments ranging from stocks to bonds. An astute capital allocator can add to the banks revenue by earning handsome returns from these products.

- Commission on 3rd party products - Banks, by virtue of being indispensable, have the advantage of being connected to society. A privilege that not all businesses enjoy. So, companies like - airlines, hotels, insurers, mutual funds, etc., often tie up with banks to gain access to their client base. The banks allow this in exchange for a commission.

Why Regulation is Required

Modern economics is such that, slowly but surely, all money stockpiles in the hands of banks. Money that actually belongs to the savers (following conservative behaviour), becomes available to borrowers (following optimistic / expansionist behaviour), through the banks.

Considering that callous bankers and indiscriminate lending practices can severely damage the entire economy, the role of a banking regulator becomes extremely important. In India, that role is played by the Reserve Bank of India.

The RBI put's checks in place to - preserve the savings of the savers, ensure that the banks are able to meet their obligations, and that inflation in the economy remains in check.

Further, banks too at their level, put checks in place to assess the credit-worthiness of the borrower, and the end use of funds before sanctioning loans.

Coming back to our example above, what would happen if Y needs their money back on say, 22nd September? The bank can't deny the request. So what can Bani's Bank do?

They have a two options -

- Borrow from other banks - Inter-bank borrowing is common all around the world. The tenure of such borrowing is usually less than a day (referred to as overnight borrowing), and rarely crosses 3 months. This allows banks flush with funds to earn an interest on the money they're holding; and other banks in need of funds to meet their needs.

- Borrow from the Reserve Bank of India (RBI) - Banks can borrow from the RBI at a rate called the Repo Rate. As an aside, a bank can lend to the RBI at a rate called Reverse-Repo. No prizes for guessing that the Reverse Repo rate is always less than the Repo rate. :) Otherwise, one can have a business model of continually borrowing from the RBI and then lending back to them.

But, it isn't healthy for any bank to have no funds at a given time. So, the RBI has mandated two requirements to ensure that some funds are always available. These are called, the Statutory Liquidity Ratio (SLR) and the Cash Reserve Ratio (CLR).

- The SLR is a percentage of all deposits accepted, that the bank must keep with itself. This money can be held in the form of - cash, gold, financial instruments approved by the RBI (usually government bonds). The current SLR is 18.5%.

- The CRR is a mandatory percentage of deposits that the bank must keep in the custody of the RBI. This is equivalent to a current account of the bank with the RBI. The current CRR is 3%.

Where Banking Has Been, And Where It is Going

Now that we have an appreciation for - what banks do and how critical their safety is to the economy, let's proceed to understand what has been, and what it looks like it's going...

The Traditional Banking Model

Banking has always been an infrastructure heavy business. Many-many branches have been opened to serve different geographies, with ATMs, and a slew of managers.

Each bank seems to have the same offerings as the next one. Barring the top few banks, all the others are failing to keep up (I wrote this article about how large corporations are getting larger). Their legacy costs are too high, their balance sheets too weak, and their personnel unwilling to realise that they now live in a consumer economy (where the customer comes first). Just try to open an account at a PSU Bank, you'll know what I mean.

Over time, this has made banking a commoditized business (in this post I explained the difference between a commodity and a differentiated product).

Conscious thought needs to be put into the business model, segments to be focused on, verticals to be exited, etc. Without a business model focus, many banks face the risk of going out of business.

We live in the age of specialization.

The way forward

In my opinion, banks of the future will take one of the following three forms -

- Champions of products, and provider of platform - These banks will manufacture financial products, and allow many other digital only banks (called Neobanks) to distribute them. They will handle the legal and regulatory layer at the bank level, while the Neobank (who by the way, don't need a banking license) will specialise in a niche segment (say student loans). Established banks are best positioned to play this role.

- Distributer model - Someone like Paytm is well positioned to do this. It already has a subscriber base, it can make a thriving business out of getting into profitable partnerships with other providers of financial products, while being mindful of protecting the customer experience.

- Segment Players - Banks who specialise in select verticals (many Neobanks are taking this route), double down on them to create high quality customer experience, along with excellent products will gain market share, for sure.

In the digital age, it all comes down to this

- Who controls demand? ⇒ The one who has the customer's attention.

- Who has the best products? ⇒ The one who innovates the most.

- Who has the lowest costs? ⇒ The one who operates at scale and is best managed.

And these can only be achieved through hard decisions.

What a business model leaves out is just as important as what it put in.

I hope you enjoyed reading this piece, thank you for your attention. :)

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.