Who controls all the money?

Exploring a central bank's role in the economy.

Table of Contents

Hey there,

I'm happy to share that STEBI is now 3 months old! About 300 hours, and 17 articles later, I can safely say - that writing online has been far more challenging and far more satisfying than I had imagined it to be when I started.

To everyone who has read, liked, retweeted or shared, any of the articles, and most importantly to those of you who have subscribed - thank you so much, from the bottom of my heart! I hope I've added some learning and joy to your life. :)

On to the week's article... I hope you'll enjoy it.

When I was a kid, I'd often wonder - "Why doesn't the government just print a lot of money and distribute it amongst the poor? That way everyone would be well off."

As I grew older, inquiry into that very question led to a better understanding about the economic system, the banking system, money, society, and the common thread running through all of them... human behaviour.

This article talks about all that, while explaining topics like central banking, inflation, quantitative easing (popularly referred to as money printing), etc. - in an easy to read format.

The working of an economy

At the helm of all economic affairs, in every country sit - the central government, and the central bank. They act as pilots to the airplane called the economy.

The central government exercises legislative control over the country. Its banker - the central bank, regulates all commercial banks that operate in the country.

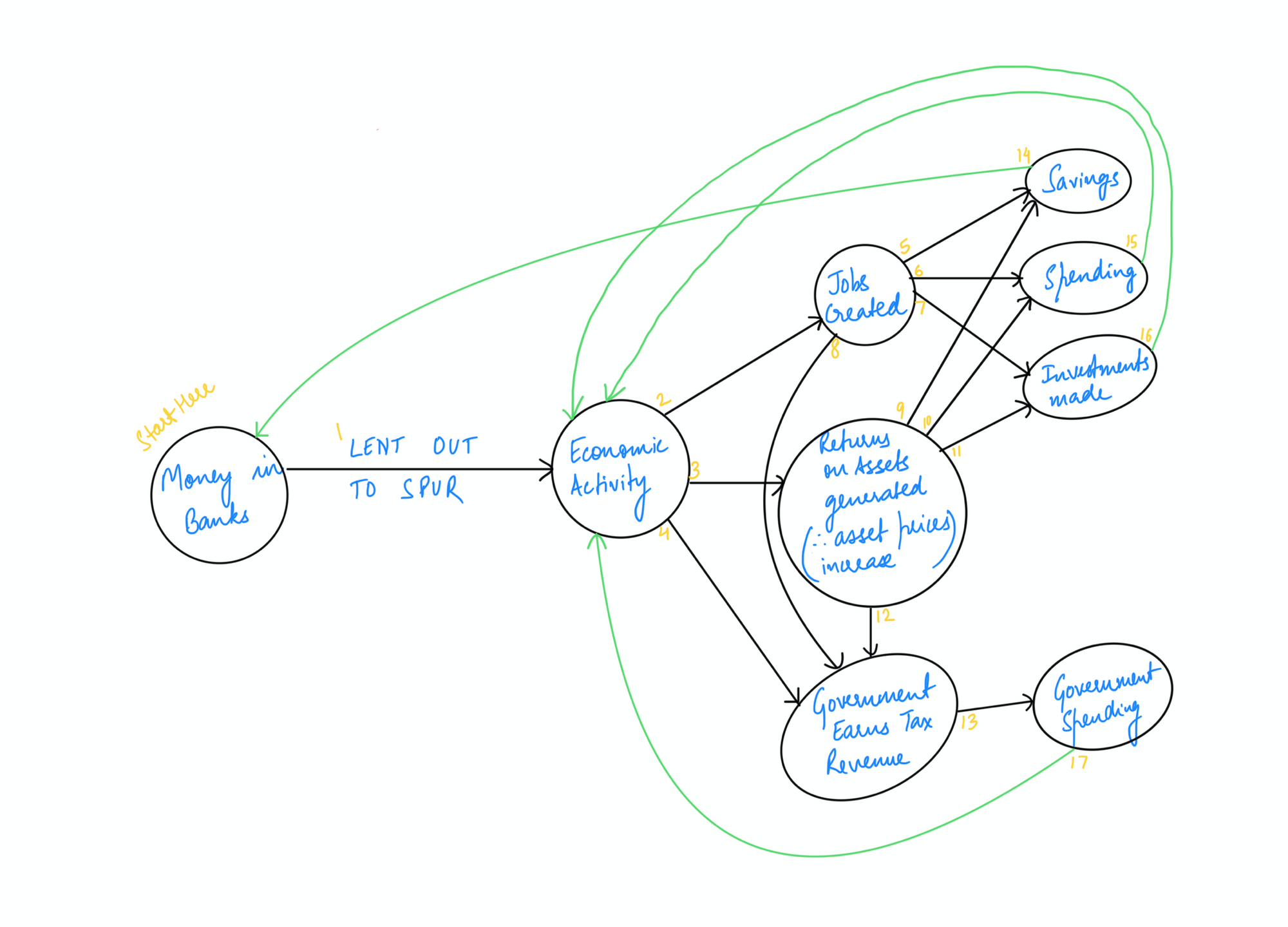

The way all this works is (see chart) -

- The central government (through strict tax laws and by offering an interest on bank deposits) ensures that the public keeps all their money with banks.

- This is done because, money hoarded outside the banking system just sits idle, bringing no benefit to the economy. Whereas money in the bank is lent further to enhance economic activity.

- Banks are required to withhold only a small percentage of all its deposits, and lend out the rest to spur economic activity.

- More economic activity leads to more jobs for the public, higher return on assets (which leads to appreciation in their prices), and higher tax revenue for the central government.

- The money generated from all this, again makes its way either into more economic activity, or to banks wherefrom it again enters the economy. This way, modern economics ensures that all outputs from economic activity, comes back as input to fuel more economic activity.

So, when I make a deposit of ₹100 at a bank, and say ₹90 from that has been lent to A as a business loan. That enables A to run business operations - pay rent (to the landlord), pay salaries (to employees), pay various vendors for supplies (raw materials, electricity, stationery, etc.), pay interest to the bank, and make a profit for the shareholders. All this was made possible due to bank credit - employment was generated, assets gave returns to their owners, and most importantly, stomachs were fed.

Now, with the working of the economy as context, let's explore the role of a central bank.

The central bank controls the supply of money to achieve high employment and low inflation in the economy.

Three things to analyse here -

- How does it control the supply of money?

- How can it achieve high employment in the economy?

- What can it do to control inflation?

Let's take them one by one.

How does it control the supply of money?

Broadly speaking it has three main tools to do so - interest rates, percentage of deposits to be kept as reserves, and money printing.

Interest Rates

Like everything else, credit has a price. That price is called interest rate (linking an article I had written about interest rates).

Every interest rate prevailing in the economy (like rate on - bank deposit, auto loan, home loan, etc.), is built on the foundational interest rate - the repo rate. The repo rate is the rate at which commercial banks procure money from the central bank.

So by increasing or decreasing the repo rate, the central bank can make credit more or less expensive (respectively) in the economy. This works well, because when the repo rate is reduced, loans are available at low rates of interest, and thus, people are more inclined to borrow. When they do borrow, they spend; and one man's spending is another man's income.

This works in the opposite direction as well if repo rates are hiked.

Percentage of deposits to be kept as reserves

A commercial bank cannot lend out 100% of the deposits it accepts from the public. A certain percentage (of these deposits) has to be kept with the central bank. And another certain percentage, needs to be withheld by the commercial bank - to meet day to day withdrawal requests from depositors.

The central bank can increase or decrease these percentages, hence, decreasing or increasing (respectively) the money commercial banks have to lend out into the economy.

To state the obvious - banks are always looking to lend (to creditworthy borrowers), in order to increase their profits.

Money Printing

Often a controversial topic, money printing (or quantitative easing), is not as complex as it's made out to be.

Think of it this way, the prosperity of any economy happens with increased human productivity, and through new findings of natural reserves (example - coal, natural gas, etc.). These two add to the goods and services produced within an economy. Now, consider that both these grow at 5% every year. If the money in the system stays the same every year, with goods and services being generated growing at 5%; what effect would that have?

The amount of money in circulation, in respect of the goods and services being produced, would be lesser than what it was in the previous year. This, when happens year after year (with goods and services growing, and the money powering their transactions staying fixed), would cause deflation - a general decline in the price of goods and services.

Imagine how devastating that can be to human morale. Those working with increased productivity will now be paid lesser. Businesses innovating to make new products would fetch lesser money in the economy, and so on.

So, in the life of an economy, when the central bank has exhausted the use of the first two methods, interest rates cannot be lowered further, and neither can mandatory deposits - money printing becomes the only way to stimulate the economy.

Come to think of it, even if the world was still using gold as money, there is around ~200,000 tonnes of gold in the world, and each year around ~2,500 tonnes of additional gold is mined, around the world. So as human productivity increases, and natural reserves are explored, and additional assets are made, it's quite natural for 'money' to also increase.

So, as long as the first two methods have been exhausted, and the economy is not facing high inflation (because adding money into the system can cause inflation) - money printing is actually a good option. The problem arises, however, when money is printed in an indiscriminate fashion.

How can it achieve high employment in the economy?

High employment is a natural result of robust economic activity and growth. Lending spurs economic growth, as explained in the diagram above.

The central bank can use its three tools to achieve this goal.

In my view though, this is more the responsibility of the central government. The central bank can only make policies with regard to the supply of money. Other policies and the general ecosystem altogether contribute to what's popularly called the 'ease of doing business' - which is more the duty of the central government.

What can it do to control inflation?

Inflation eats away at our money. There have been cases around the world of unthinkable inflation. Imagine going to the market to buy an apple, and it costs ₹ 1,000... that would be devastating!

It's the job of the central bank to ensure that the currency of the country does not fall into such steep inflation. They do this, again, by controlling the money supply in the economy using its three tools.

Too much money in the system, in relation to goods and services available, would lead to inflation. Too little, would lead to deflation, and poor economic growth.

The central bank exists to continually maintain the right balance between economic growth, and an acceptable level of inflation.

It's important to note that central banks play a very important role in modern economics. And though article presents a broad view of its operations, the writer fully appreciates the complex nature of a central bank's job.

So, to conclude - "Why doesn't the government just print a lot of money and distribute it amongst the poor? That way everyone would be well off."

Because, wealth is a proof of work, and it cannot just be distributed without it being earned. Besides, indiscriminate printing of money would lead to inflation.

Thanks for reading. :)

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.