CompanyAnalysis: HCL Technologies Limited

Reimagining Tomorrow's Enterprise...

Table of Contents

Hi there!

Welcome to my first Company Analysis report on Stebi. I’m really happy you’re here, and hope to make it worth your while.

Most investment reports are hard to read; this is an attempt to change that. Though I’ve tried to make it comprehensible, this endeavour demands the use of accounting and business concepts here and there. So, I hope to balance, readability and usefulness, without making it downright rudimentary. Here we go!

The report has the following parts:

👉🏼 Background | The Business | Is it Good? | Is it Cheap? | Conclusion

Background

In 1976, Shiv Nadar along with five of his friends founded a hardware focussed technology company called Microcomp Limited; which soon became Hindustan Computers Limited. As the company grew, opportunities started appearing in allied segments. In 1991, another company called HCL Overseas Limited was started to provide software development services. This company’s name was changed to HCL Technologies Limited in 1999. Thereafter, it came out with an IPO (initial public offer - the public is invited to give money to the company. In return, equity shares of the company are issued to them. And these shares are listed on a stock exchange, so they can be bought and sold with ease). HCL Technologies has been listed on stock exchanges in India since January 2000, and is a constituent of both frontline indices — the Nifty50 and the Sensex.

First, know the business!

Let’s understand each facet of the business.

👉🏼 Products / Services | Customers | Industry | Geography

Products / Services

The company categorises its offerings into three categories:

- IT Business Services - Here, the company consults on, and puts in place IT infrastructure in large organisations. It’s usually a project that entails end-to-end digital transformation of all operations of the client; or it’s a small project, which if successful, leads to an end-to-end digital transformation project from the same client. At a functional level, these services can range from cybersecurity, cloud services, and internet of things adoption, to digital workplaces (a place where a company’s employee’s can collaborate digitally), BPO (process outsourcing), and data analytics.

- Engineering and Research & Development Services - Here, the company takes up projects to develop softwares as needed by clients. This can be at any or all of the four levels of development — idea, design, making, and maintaining. Due to the constant change that IT is going through, and with new technologies like 5G, AI/ML, IoT, Blockchain, AR/VR, and 3D printing, there is a massive demand for such services.

- Products & Platforms - Here, the company offers proprietary software products in areas like — client experience, enterprise digitisation, automation, and DevSecOps (fancy word for when IT security is embedded into every step of software development).

In most cases, the company signs an agreement to deliver a service, and bills the clients upon completion on certain stages in that assignment. And hence, receives those payments.

Customers

Large organisations operating in the following industries:

- Life Sciences & Healthcare (to capitalise on opportunities like telemedicine, remote patient monitoring, virtual trials, etc.)

- Manufacturing (to capitalise on opportunities arising from supply chain innovations, improving customer engagement, using IoT, AI, ML, Natural Language Processing, etc.)

- Public Services (in industries like Travel, Transportation Logistics and Hospitality. Oil and Gas. Aerospace and Defence)

- Retail and Consumer Packaged Goods (presents many opportunities due to changes like — low/no touch interface, online selling, flexible supply chains, data insights to ascertain cost reduction opportunities)

- Technology (you must be thinking: Hey! Why would a technology company need the services of another technology company? Good question. But there are multiple opportunities. For example, a semiconductor technology company, could use a company like HCL to upgrade the quality of their digital assets, or to digitise the workflow in their factory.)

- Telecom Media and Entertainment (opportunities like the demand for personalised multi-device customer experience, and the upcoming disruptions from the advent of IoT, AI, ML, AR, VR, 5G, streaming, and fibre-based connectivity.)

It’s good to see a focussed, vertical specific marketing approach. Rather than an ad-hoc one.

Industry

HCL operates in the IT services, consulting, and execution industry; an industry in which Indian companies are globally competitive.

Geography

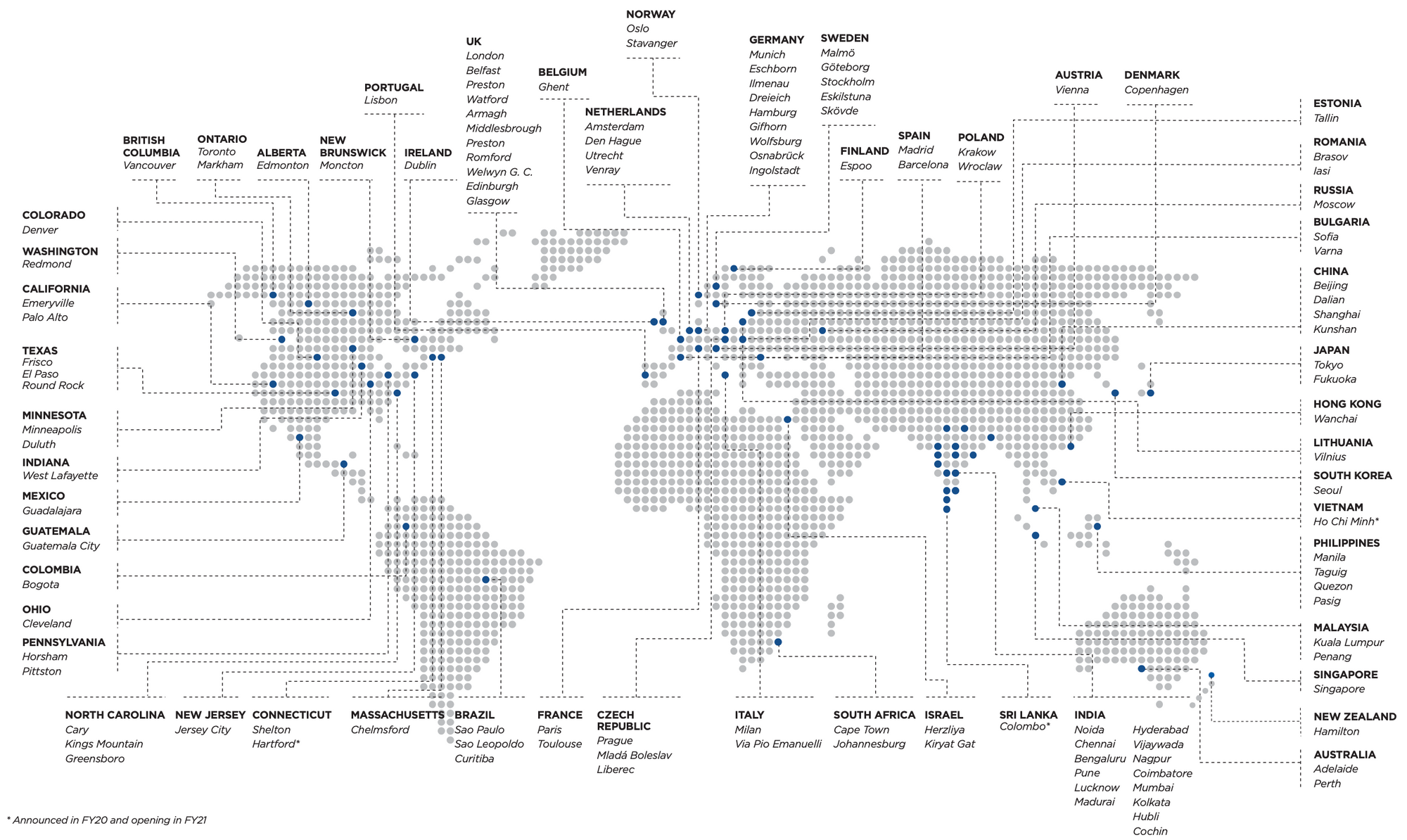

HCL Technologies has a presence across six continents.

Second, see whether it is a good business?

Accounting tells us whether it’s been good in the past. (Screener is a wonderful website where all relevant accounting data can be seen clearly — here’s a link to it.)

- Revenue has been growing at a healthy average of 15%, over the last 3 years.

- Operating Profit has been growing at an impressive average of 19% over the last 3 years. What makes this great is that the rate of profit growth is higher than the rate of revenue growth. This means that as the company earns a higher revenue, it incurs lesser proportionate costs, to fulfil those projects.

- Cash Flow from Operations (measures the flow of cash into the business from operating activities), saw a sizeable jump in FY20. This is partly due to a change in accounting rules, rather than an actual, substantial improvement in recoveries.

- Debtors have been growing at around 20% every year; a growth rate higher than that of revenue. This is an undesirable sign since it implies that — if I made sales of ₹100 during the year, of that, at the end of the year, I had yet to receive ₹20; but by the next year, I had grown my sales to 115 (i.e. 15% growth), but now, my customers had yet to pay me ₹24.

- Debt has increased. A short-term bank overdraft facility that has been availed by the company. This again points towards the rising debtors. When inflow of money is delayed, but outflows (like salaries) still have to be made on time, businesses usually raise debt. Since the company is well capitalised, and has many financial assets, it’s able to arrange money at low rates of interest. So, the rising debtors isn’t a problem for now. But it could become one if this trend continues.

It would be great to see the company reduce its debtors as a percentage of revenue. And if that happens, debt would automatically reduce since the company wouldn’t need the extra funds from outside. - Profit after tax, as a percentage of Net Worth (adjusted for dividends and buybacks), has on average been 21% over the last three years. Again, very impressive.

Business strategy guides us towards whether it’s likely to be good in the future.

- Breadth analysis - Let’s ask two questions.

One, is the customer base broad and unlikely to consolidate? Yes!

And two, is the company’s supplier base broad and unlikely to consolidate? Yes! Here since it’s a services company, the relevant supplier base is their ability to find talented individuals. And that definitely is available aplenty. - Forces analysis: Porters five forces.

One, Competition in the industry - Cut-throat. Major competitors include - TCS, Infosys, Wipro, Tech Mahindra, and L&T Infotech.

Two, Potential of new entrants into the industry - Low. It’s exceptionally hard to set up a company that can offer a range of IT services that these companies can offer. And large clients usually like to deal with just one IT company for all their needs.

Three, power of suppliers - Low. No dearth of IT talent.

Four, power of customers - Low. Once a contract price is negotiated, the customer can’t do much to change pricing.

Five, threat of substitutes - Low. With constant changes in IT, all large organisations need an IT service provider that can cater to all their needs. And companies like HCLTech continuously expand their capabilities to be the go-to tech solution provider for their clients. - Moat identification: A moat is a sustainable competitive advantage. For me, HCLTech’s moat comes from — their ingrainedness with their clients, and the high switching-costs that a large client incurs while switching their IT vendor. And additionally from their size and scale which allows them to cater to ever-increasing client needs in a constantly transforming space.

- Whether the total addressable market for the company’s offerings is growing? — Undoubtedly… yes!

Even if the company is excellent, we need to assess whether its shareholder friendly. The following should guide us:

- Unreasonable compensation to management - reasonable for a company of this size and in this industry.

- Related party transactions - nothing out of the ordinary.

- Share buybacks - Once in 2017, and again in 2018. Both times at a premium to prevailing market prices.

- Dividends - regular.

And finally, is it available at a reasonable price?

While investing, the biggest mistake one can make is, to pay too much for the investment. In a neighbourhood where the average house sells for X , maybe for an extra special house 1.5X can be a good price, but 10X for the same house would be egregious.

- HCL Technologies is currently trading at a price to earnings ratio of 18.8, which is lesser than its main competitors. This makes it seem reasonably priced.

- It's trading at a price to book ratio of 4.38, which is somewhere in the middle of the pack when compared to its industry peers.

Conclusion

HCL Technologies is a strong player in an industry which is in its heyday. A strong, globally prevalent business presence places them well on the path to do well in the future.

If you’ve reached till here, thank you for the patient read. I hope this helped you understand HCL Technologies better. :)

I plan to write one CompanyAnalysis article every month, and am driven to make them my best articles. The goal is to be regular, and hence get better! :)

For safe measure, here’s my disclaimer.

Stebi Newsletter

Join the newsletter to receive the latest updates in your inbox.